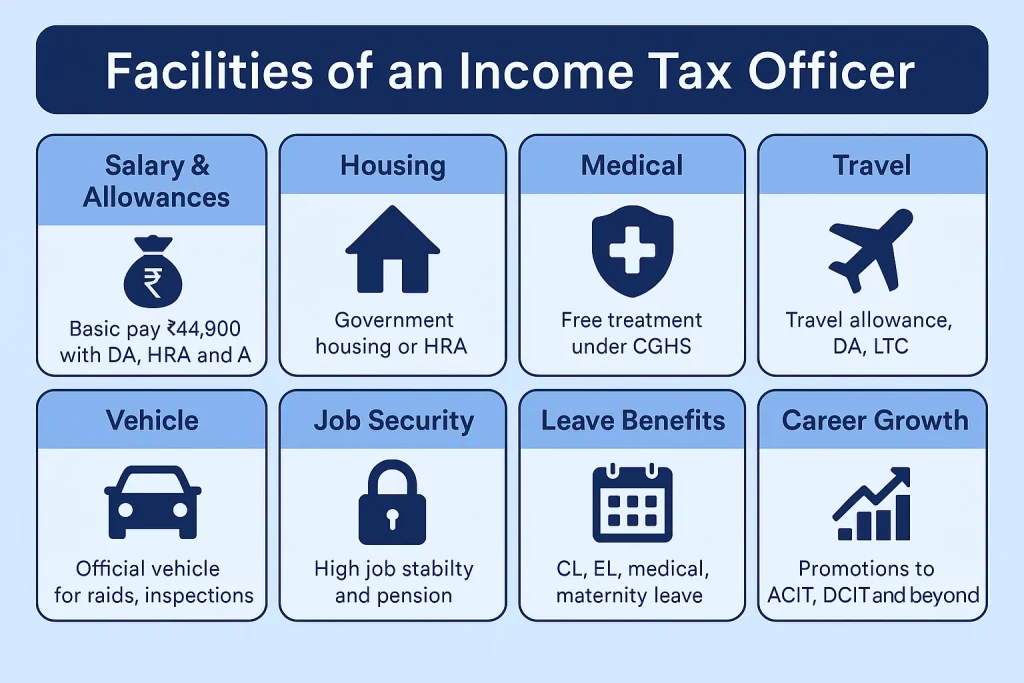

Becoming an Income Tax Officer (ITO) is not just about prestige and authority it also comes with a range of facilities, perks, and benefits that make it one of the most attractive government jobs in India.

Every year, thousands of aspirants prepare through the SSC CGL (Combined Graduate Level) Examination to secure this post, not only for the salary but also for the long-term stability and facilities that the government provides to its officers.

In this article, we will explore in detail the facilities of an Income Tax Officer—from salary, allowances, and housing, to job security, medical benefits, travel perks, and career growth opportunities.

By the end, you’ll have a clear idea of why this position is regarded as one of the most sought-after jobs in the Indian bureaucracy.

Table of Contents

1. Overview of the Income Tax Officer Post

- Recruiting Body: Staff Selection Commission (SSC)

- Exam: SSC CGL (Combined Graduate Level)

- Department: Central Board of Direct Taxes (CBDT), Ministry of Finance

- Post: Inspector of Income Tax (later promoted as Income Tax Officer)

- Job Role:

- Assessing income tax returns of individuals and companies

- Conducting surveys and raids against tax evasion

- Collecting revenue for the government

- Ensuring compliance with tax laws

With such responsibilities, the government ensures that its officers are well-compensated and supported with facilities that allow them to perform effectively.

2. Salary Structure of an Income Tax Officer

The basic financial facility of any job is the salary, and for ITOs, it is highly rewarding compared to other SSC CGL posts.

Pay Level & Structure:

- Pay Level: 7 (as per 7th CPC)

- Basic Pay: ₹44,900 per month

- Grade Pay: ₹4,600

- Pay Scale: ₹44,900 – ₹1,42,400

Total In-Hand Salary:

Including allowances like HRA, DA, and TA, the in-hand salary of an ITO usually falls between:

- ₹75,000 – ₹95,000 per month (depending on posting location).

Officers posted in metro cities like Delhi, Mumbai, Bengaluru, or Kolkata receive higher HRA compared to Tier-II and Tier-III cities.

3. Allowances and Perks

In addition to the salary, an Income Tax Officer enjoys various allowances and facilities:

(A) House Rent Allowance (HRA)

- 24% of Basic Pay in X cities (metros)

- 16% in Y cities (Tier-II)

- 8% in Z cities (Tier-III)

- Example: In Delhi, HRA ≈ ₹10,776/month.

(B) Dearness Allowance (DA)

- DA is revised quarterly based on inflation.

- As of 2025, DA is over 50% of Basic Pay.

(C) Transport Allowance (TA)

- ₹3,600–₹7,200 (depending on city) + DA.

- Officers often also get official vehicles during raids or inspections.

(D) Special Duty Allowances

- Officers posted in difficult areas like Northeast India receive additional allowances.

4. Housing & Accommodation Facilities

Housing is one of the most attractive facilities for Income Tax Officers.

- Government Quarters: ITOs are eligible for spacious, well-maintained government flats in prime city locations.

- Furnished Accommodation: Many postings include fully furnished houses with subsidized rent.

- Guest Houses: Access to Income Tax guest houses across India during official tours.

For officers in expensive metros like Delhi and Mumbai, this facility saves lakhs of rupees annually.

5. Medical Facilities

Healthcare is fully covered for Income Tax Officers and their dependents.

- Central Government Health Scheme (CGHS): Free or subsidized treatment in government and empaneled private hospitals.

- Reimbursements: Medical expenses not covered under CGHS are reimbursed.

- Family Coverage: Includes spouse, children, and dependent parents.

This facility ensures complete financial security against health-related issues.

6. Travel Facilities

Income Tax Officers often travel for official inspections, raids, or surveys. To support this, they get:

- Travel Allowance: Reimbursement of travel expenses.

- Daily Allowance (DA): For food, lodging, and incidentals during official tours.

- Air Travel Eligibility: Senior officers are eligible for air travel reimbursement.

- Railway Travel Concessions: Subsidized tickets for officers and their families.

This makes both official and personal travel highly affordable.

7. Vehicle Facilities

While not provided for daily commute, officers are given government vehicles with drivers during:

- Raids & searches

- Official inspections

- Survey operations

This ensures safety, mobility, and efficiency in carrying out their duties.

8. Job Security and Stability

Government jobs are known for their job security, and for an ITO, this is one of the strongest facilities:

- No arbitrary termination (protected under government service rules).

- Pension and post-retirement benefits.

- Regular salary increments and pay revisions.

- Security against economic slowdowns or private sector layoffs.

Once you become an ITO, you have lifelong job stability and financial security.

9. Retirement & Pension Facilities

The facilities don’t end with retirement. Income Tax Officers receive:

- Pension: 50% of last drawn salary.

- Dearness Relief (DR): Pension linked with DA increases.

- Gratuity: Lump-sum payment after retirement.

- Leave Encashment: Unused earned leaves are encashed at retirement.

This ensures dignity and financial independence even after service.

10. Leaves and Holidays

ITO facilities also include generous leave benefits:

- Casual Leave (CL): 8 days per year.

- Earned Leave (EL): 30 days per year.

- Medical Leave: As per requirement.

- Maternity/Paternity Leave.

- Gazetted Holidays + Restricted Holidays.

This allows officers to maintain a healthy work-life balance.

11. Career Growth & Promotions

Another facility that makes the ITO post attractive is fast promotions and career advancement:

Promotion Hierarchy:

- Income Tax Inspector (entry through SSC CGL)

- Income Tax Officer (after 3–6 years)

- Assistant Commissioner of Income Tax (ACIT)

- Deputy Commissioner of Income Tax (DCIT)

- Joint Commissioner of Income Tax (JCIT)

- Additional Commissioner of Income Tax (Addl. CIT)

- Commissioner of Income Tax (CIT)

- Principal Chief Commissioner of Income Tax

With each promotion, salary, facilities, and authority increase significantly.

12. Social Status and Respect

Though intangible, the social respect and authority that comes with being an Income Tax Officer is itself a major facility:

- Respected in society for representing the government.

- Authority during raids and tax assessments.

- Strong professional network with bureaucrats, lawyers, and financial experts.

This respect often translates into better opportunities for family members too.

13. Work-Life Balance Facilities

Unlike some high-pressure government jobs, Income Tax Officers enjoy relatively balanced work-life conditions:

- Working Hours: Mostly 9:30 AM – 6 PM (except during raids).

- 5-day Week: Most offices follow a Monday–Friday schedule.

- Official Tours: Limited but well-compensated.

- Family Time: Ample time for personal life compared to private corporate jobs.

Also Read:

- What is the work of income tax officer?

- Income tax officer qualification

- Income tax department officer list

14. Additional Perks

Some other facilities include:

- LTC (Leave Travel Concession): Free travel for family to any part of India once every 2 years.

- Children’s Education Allowance: Reimbursement for children’s schooling.

- Insurance Benefits: Group Insurance and Provident Fund.

- Laptop/Computer Facility: Provided for official work.

15. Challenges Alongside Facilities

While the facilities are attractive, it’s important to know the challenges:

- Workload during financial year-end.

- Pressure during raids and investigations.

- Transfers every few years (affecting family settlement).

- Political or social pressure in sensitive cases.

However, the facilities provided balance out these challenges, making it a rewarding career.

16. Facilities Compared to Other SSC CGL Posts

| Post | Salary | Perks | Housing | Authority | Growth |

|---|---|---|---|---|---|

| Income Tax Officer | High | Excellent | Yes | High | Very Good |

| Excise Inspector | Moderate | Good | Yes | Moderate | Good |

| CBI Sub-Inspector | Moderate | Limited | No | High | Good |

| Assistant in Ministries | Moderate | Excellent | Yes | Low | Moderate |

Clearly, ITO stands out as one of the most balanced posts combining financial facilities, perks, and authority.

17. Why Aspirants Aim for ITO Facilities

Most SSC CGL aspirants prioritize ITO because:

- High salary & allowances

- Government housing in metros

- Medical & retirement security

- Balanced lifestyle + social status

- Fast promotions compared to other posts

Also Read:

- Income tax officer eligibility for female

- How to become a income tax officer after 12th

- Income tax officer exam syllabus

- Income tax officer age limit

- Income tax officer salary

- Income tax officer car

Conclusion

The facilities of an Income Tax Officer go far beyond salary. From housing and medical care to travel perks, retirement benefits, and social status, the government ensures that its officers live a comfortable and secure life while performing their critical duty of maintaining India’s revenue system.

For aspirants, the ITO post is not just a job but a gateway to financial stability, authority, and respect in society. Yes, the path is competitive through the SSC CGL exam, but the facilities, lifestyle, and career growth make it worth every effort.