Becoming an Income Tax Officer (ITO) is a dream for many young aspirants in India. This position comes with immense respect, stability, and authority in the government sector. However, one of the most common questions students ask is:

- Can I become an Income Tax Officer after 12th?

- What steps should I follow after my school education?

- What is the exact roadmap to this prestigious career?

In this article, we’ll cover the detailed process from 12th standard to securing the position of Income Tax Officer, including eligibility, exams, preparation strategies, and inspiration from the journey of successful officers. This guide is designed to give you a step-by-step pathway to plan your career early and achieve your goal with focus and clarity.

Table of Contents

Understanding the Role of an Income Tax Officer

An Income Tax Officer is a government officer working under the Income Tax Department of India. Their primary responsibilities include:

- Assessing, collecting, and managing income tax from individuals and organizations.

- Conducting raids and investigations in cases of tax evasion.

- Maintaining accurate tax records and ensuring compliance with tax laws.

- Handling administrative and supervisory duties within the department.

The position demands analytical skills, decision-making ability, integrity, and discipline. It is not just a job, but a role in nation-building by ensuring India’s economic system remains transparent and fair.

Step 1: Eligibility After 12th

Can You Apply Directly After 12th?

The short answer is No – you cannot directly apply for the post of Income Tax Officer after 12th.

The minimum educational qualification required is a Bachelor’s Degree from a recognized university.

However, completing 12th is the first milestone in your journey. What you do after 12th will shape your preparation and success.

Also read

- What is income tax officer eligibility for female?

- What is the work of income tax officer?

- Income tax officer qualification

- Income tax department officer list

- Income tax officer car

Step 2: Choose the Right Graduation Path

After completing your 12th, you must pursue a graduation degree (any stream – Arts, Commerce, or Science). The Staff Selection Commission (SSC) only requires that candidates should be graduates from a recognized university.

Recommended Streams After 12th

- Commerce Stream (B.Com, BBA, BMS, etc.):

- Advantage in taxation, accounting, and business laws.

- Easier understanding of financial aspects in exams.

- Arts Stream (BA in Political Science, Economics, History, etc.):

- Strong preparation base for General Awareness, Polity, and Current Affairs.

- Useful for essay writing and descriptive papers.

- Science Stream (B.Sc, B.Tech, etc.):

- Logical reasoning and quantitative skills may be stronger.

- Good for SSC CGL’s Math and Reasoning section.

Tip: Choose a subject you are comfortable with, as your focus should remain on preparing for the SSC CGL Exam alongside your graduation.

Step 3: Understanding the SSC CGL Pathway

To become an Income Tax Officer, you must clear the SSC CGL (Combined Graduate Level) Examination conducted by the Staff Selection Commission.

SSC CGL – Exam Structure

The exam is conducted in four stages:

1. Tier I – Preliminary (Computer-Based Test)

- General Intelligence & Reasoning

- General Awareness

- Quantitative Aptitude

- English Comprehension

2. Tier II – Mains (Computer-Based Test)

- Quantitative Abilities

- English Language & Comprehension

- Statistics (for certain posts)

- General Studies (Finance & Economics)

3. Tier III – Descriptive Paper (Pen & Paper Mode)

- Essay writing, Letter/Application writing in English/Hindi

4. Tier IV – Skill Test/Computer Proficiency Test/Document Verification

Candidates who clear all tiers are allotted posts based on merit, preference, and availability.

The Income Tax Officer post falls under Group B (Gazetted) and Group C in the Central Government pay scale, making it one of the top preferences among candidates.

Step 4: Age Limit Criteria

- Minimum Age: 18 years

- Maximum Age: 30 years

- Relaxations:

- OBC: +3 years

- SC/ST: +5 years

- PwD: +10–15 years (depending on category)

Since students usually complete graduation around 21 years, the age window is sufficient for multiple attempts.

Step 5: Salary and Perks of an Income Tax Officer

The Income Tax Officer post falls under Pay Level-7 (₹44,900 – ₹1,42,400) with additional allowances like:

- House Rent Allowance (HRA)

- Dearness Allowance (DA)

- Transport Allowance

- Medical benefits

Gross salary: ₹60,000 – ₹80,000 per month (depending on posting location).

Other perks include:

- Job security

- Government housing (in some cases)

- Opportunities for promotion to higher ranks like Assistant Commissioner, Deputy Commissioner, and Commissioner of Income Tax.

Step 6: Preparation Strategy After 12th

Since you cannot directly apply after 12th, your preparation journey starts during your graduation. Here’s how you can use those years effectively:

First Year of Graduation (Foundation Stage)

- Build strong basics in Math, English, and Reasoning.

- Read NCERT books (Class 6–12) for General Knowledge and History/Polity basics.

- Start reading a daily newspaper (The Hindu/Indian Express) for Current Affairs.

Second Year of Graduation (Intermediate Stage)

- Solve previous years’ SSC CGL papers.

- Join online/offline coaching if necessary.

- Practice answer writing for the descriptive paper.

Final Year of Graduation (Advanced Stage)

- Take mock tests regularly.

- Revise core concepts.

- Focus on weak areas and time management.

- Prepare for physical fitness if aiming for field postings.

Step 7: Physical Standards for Income Tax Officer

Since Income Tax Officers may be required to conduct raids and field duties, candidates must meet certain physical standards:

- Height:

- Male: 157.5 cm (relaxable for some categories)

- Female: 152 cm

- Chest (for males): 81 cm (with expansion)

- Physical Tests:

- Walking: 1600 meters in 15 minutes (male), 1 km in 20 minutes (female)

- Cycling: 8 km in 30 minutes (male), 3 km in 25 minutes (female)

These standards are checked during selection and training.

Step 8: Training of an Income Tax Officer

After selection, candidates undergo training at the National Academy of Direct Taxes (NADT), Nagpur. Here they are trained in:

- Taxation laws and procedures

- Investigation techniques

- Raids and search operations

- Office and administrative skills

This training prepares them for real-life challenges in the Income Tax Department.

Inspirational Lessons from Income Tax Officers

While the journey may seem long – from 12th to graduation to SSC CGL – countless students have proven that discipline and dedication can make it possible.

What You Can Learn from Their Journey

- Patience: Success doesn’t come overnight. Preparing for 3–4 years shows that long-term consistency is the key.

- Determination: Many officers clear the exam in their second or third attempt. Their persistence inspires us not to give up.

- Hard Work + Smart Work: They balance academics with targeted SSC CGL preparation.

- Service Mindset: The role is not just about a job; it’s about serving the nation honestly.

Did you know yuzvendra chahal was also a income tax officer?

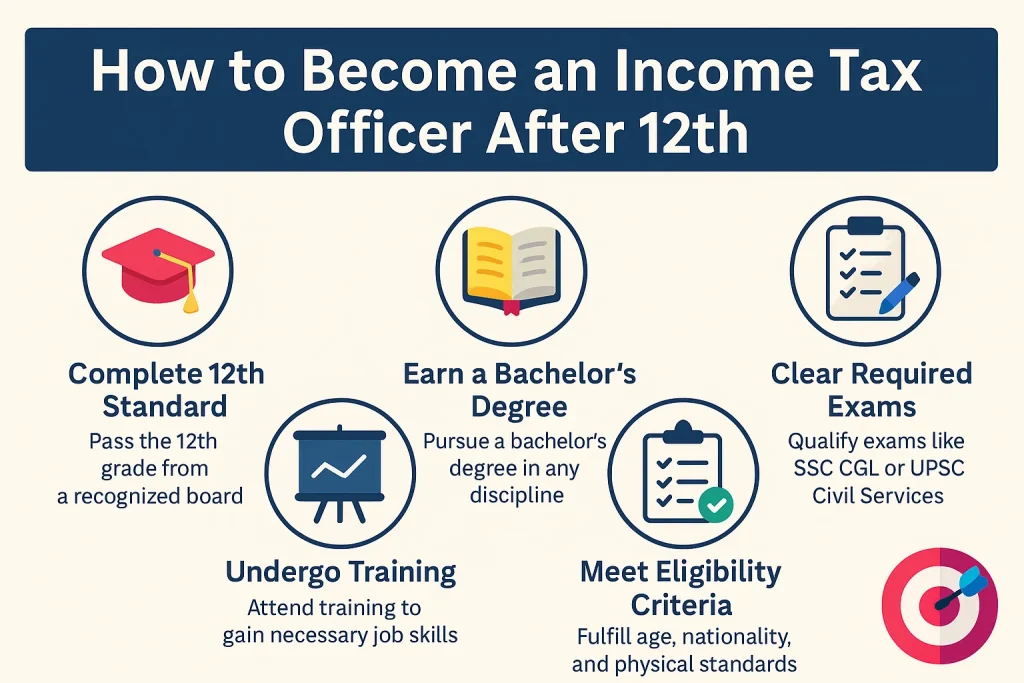

Step-by-Step Roadmap (Summary)

- Complete 12th standard from any stream.

- Pursue a graduation degree (3 years minimum).

- Start SSC CGL preparation during graduation (focus on Math, English, GK).

- Apply for SSC CGL after graduation.

- Clear all four tiers of SSC CGL.

- Meet age and physical standards.

- Complete training at NADT Nagpur.

- Join as an Income Tax Officer.

Final Thoughts

The journey to becoming an Income Tax Officer after 12th may seem like a long road, but with proper planning, determination, and patience, it is absolutely achievable.

Remember:

- 12th is just the beginning.

- Graduation is your opportunity to build a strong foundation.

- SSC CGL is the final gateway to your dream.

Take inspiration from the officers who started their journey just like you – with dreams, hard work, and resilience. If they can achieve it, so can you.

Your success will not just be about securing a government job, but about contributing to India’s economic strength and integrity.