The Income Tax Department (ITD) is one of India’s most powerful and essential government departments.

Operating under the Ministry of Finance and the Central Board of Direct Taxes (CBDT), this department is responsible for administering and collecting direct taxes, ensuring compliance with tax laws, and investigating tax evasion cases.

Aspirants who dream of working in this department or citizens who want to understand its structure often search for the Income Tax Department Officer List — which essentially refers to the hierarchy and ranking of officers working within the department, from top-level commissioners to entry-level inspectors.

In this article, we will explore the complete officer list of the Income Tax Department, including:

Table of Contents

By the end, you’ll have a detailed picture of every officer rank — making it especially useful for government job aspirants, students of public administration, and anyone curious about India’s taxation system.

What Is the Income Tax Department?

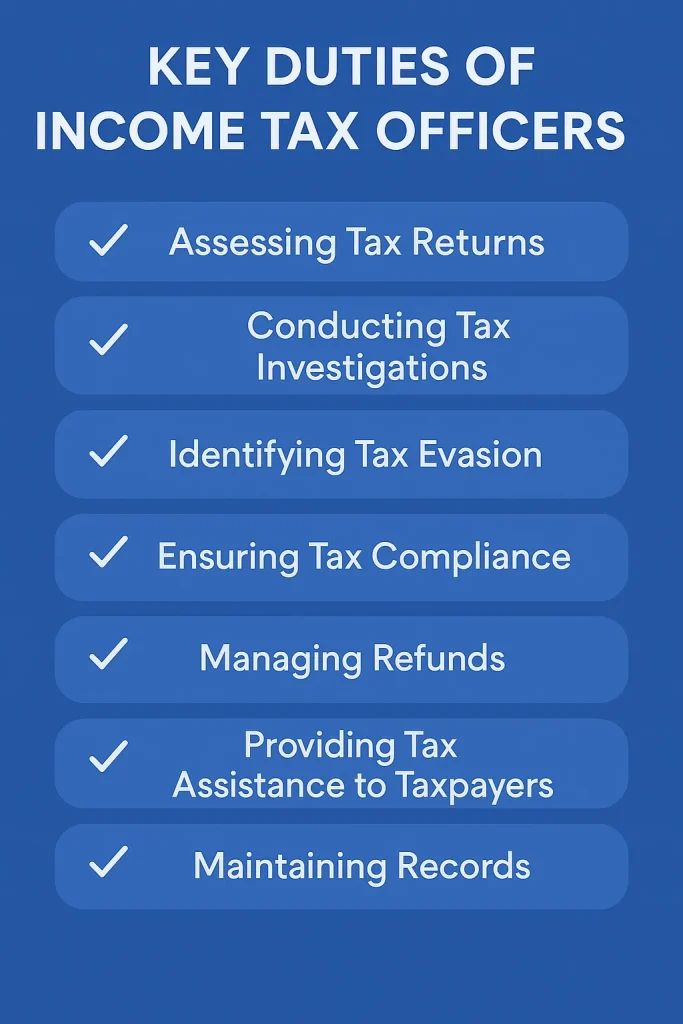

The Income Tax Department (ITD) is an agency of the Government of India responsible for:

- Assessing, collecting, and enforcing direct taxes, including Income Tax, Corporate Tax, and Wealth Tax (until it was abolished).

- Implementing tax laws under the Income Tax Act, 1961.

- Preventing tax evasion and black money through surveys, searches, and raids.

- Processing refunds and appeals through its regional and central offices.

The department operates under the Central Board of Direct Taxes (CBDT), which is part of the Department of Revenue, Ministry of Finance.

Section 1: Understanding the Income Tax Department Officer List

The officer list of the Income Tax Department is a hierarchical structure of ranks — starting from the most senior officers at the central policy-making level (CBDT) to the officers working on field investigations and tax assessments.

This structure is divided into two major categories:

1. Group A Officers (IRS – Indian Revenue Service)

These officers belong to the Indian Revenue Service (Income Tax) cadre and are recruited through the UPSC Civil Services Examination. They hold key managerial, supervisory, and decision-making positions.

2. Group B, C & D Officers (Non-IRS Cadre)

These are recruited mainly through the Staff Selection Commission (SSC) or other departmental recruitment processes. They form the operational backbone of the department — working as inspectors, assistants, clerks, and support staff.

Section 2: Complete Income Tax Department Officer List (Top to Bottom)

Below is the official rank-wise list of officers in the Income Tax Department, along with their group classification and brief role explanation.

| Rank/Designation | Group | Recruitment Mode | Primary Role |

|---|---|---|---|

| 1. Chairman, CBDT | Apex Scale | Appointed by Government of India | Head of the Central Board of Direct Taxes; top authority in direct tax administration. |

| 2. Members, CBDT | Apex Scale | Senior IRS Officers | Policy-making, administration, and overseeing different wings (Investigation, Legislation, etc.). |

| 3. Principal Chief Commissioner of Income Tax (Pr. CCIT) | HAG+ | Promotion from Chief Commissioner | Head of an entire region or state; oversees multiple zones. |

| 4. Chief Commissioner of Income Tax (CCIT) | HAG | Promotion | Supervises all Commissioners within a region. |

| 5. Principal Commissioner of Income Tax (Pr. CIT) | Senior Administrative Grade | Promotion | Leads divisions and handles major cases and appeals. |

| 6. Commissioner of Income Tax (CIT) | Senior Administrative Grade | Promotion | Supervises assessment circles, approves important files. |

| 7. Additional Commissioner of Income Tax (Addl. CIT) | Junior Administrative Grade | Promotion | Assists Commissioner in managing groups of assessing officers. |

| 8. Joint Commissioner of Income Tax (JCIT) | Junior Administrative Grade | Promotion | Supervises multiple Income Tax Officers; oversees operations. |

| 9. Deputy Commissioner of Income Tax (DCIT) | Senior Time Scale | Promotion | Handles assessments of high-profile or corporate cases. |

| 10. Assistant Commissioner of Income Tax (ACIT) | Group A (IRS) | Direct recruitment via UPSC | Entry-level IRS officer; conducts audits, inquiries, and assessments. |

| 11. Income Tax Officer (ITO) | Group B (Gazetted) | Promotion from Inspector (via SSC) | Supervises Inspectors and clerical staff; conducts raids and inspections. |

| 12. Inspector of Income Tax (ITI) | Group C | SSC CGL Exam | Field officer for surveys, verification, and tax collection. |

| 13. Executive/Tax Assistant | Group C | SSC CHSL / Departmental | Administrative support; assists inspectors. |

| 14. Notice Server / LDC / Clerk | Group C/D | Departmental | Office support and documentation. |

| 15. Multi-Tasking Staff (MTS) | Group D | SSC MTS Exam | Basic clerical, office, and support duties. |

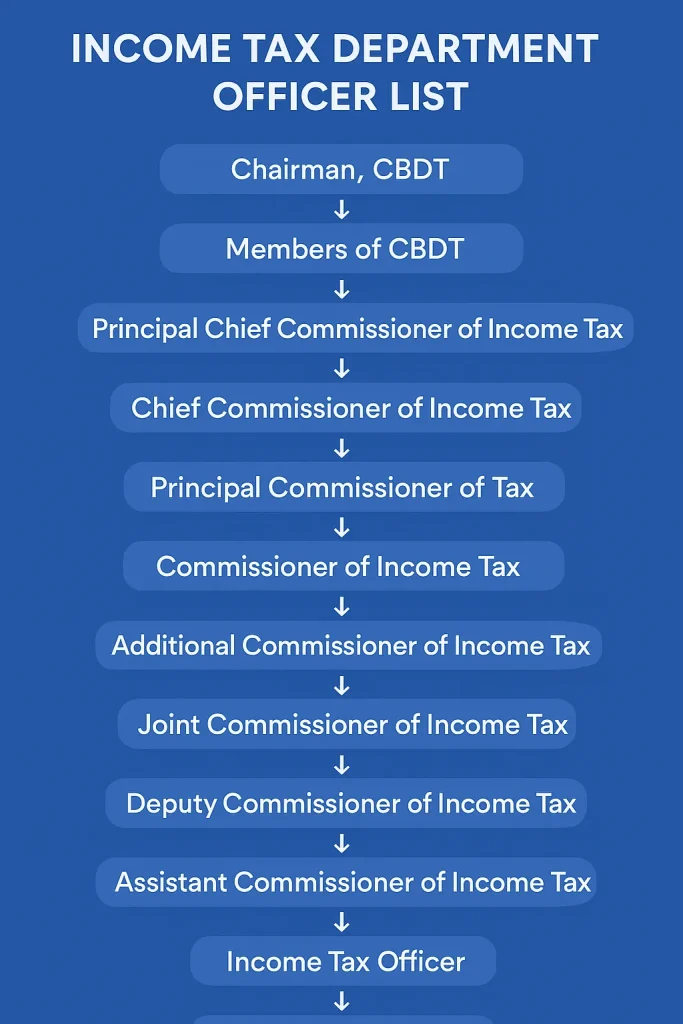

Section 3: Hierarchy Chart of Income Tax Department Officers

To visualize it clearly, here’s the hierarchical chart of all officer ranks (from top to bottom):

Chairman, CBDT

↓

Members of CBDT

↓

Principal Chief Commissioner of Income Tax

↓

Chief Commissioner of Income Tax

↓

Principal Commissioner of Income Tax

↓

Commissioner of Income Tax

↓

Additional Commissioner of Income Tax

↓

Joint Commissioner of Income Tax

↓

Deputy Commissioner of Income Tax

↓

Assistant Commissioner of Income Tax

↓

Income Tax Officer

↓

Inspector of Income Tax

↓

Tax Assistant / Executive Assistant

↓

Clerical Staff / MTS

This chain of command ensures accountability and efficient functioning — from policy decisions at the top to implementation at the ground level.

Section 4: Role and Responsibilities of Each Officer

Let’s understand what each officer actually does within the department.

1. Chairman, CBDT

- Heads the Central Board of Direct Taxes.

- Advises the Finance Minister on direct tax administration.

- Supervises all field formations across India.

2. Members of CBDT

There are six members, each heading a major division:

- Member (Investigation)

- Member (Legislation & Computerisation)

- Member (Revenue)

- Member (Administration)

- Member (TPS – Taxpayer Services)

- Member (Audit & Judicial)

3. Principal Chief Commissioner of Income Tax (Pr. CCIT)

- Head of a large region (e.g., Mumbai, Delhi, Chennai).

- Supervises Chief Commissioners in that region.

4. Chief Commissioner of Income Tax (CCIT)

- Handles multiple Commissioners.

- Ensures uniform implementation of tax laws.

5. Principal Commissioner / Commissioner (CIT)

- Directs assessments of large taxpayers.

- Handles appeals and revisions.

- Supervises administrative and vigilance matters.

6. Additional / Joint Commissioner (Addl./JCIT)

- Oversees groups of ITOs.

- Reviews assessments and approves search operations.

7. Deputy Commissioner / Assistant Commissioner (DCIT/ACIT)

- Conducts audits, tax assessments, and investigations.

- Handles cases involving corporate and high-net-worth individuals.

8. Income Tax Officer (ITO)

- Executes field duties such as surveys and search operations.

- Supervises Inspectors and ensures tax collection targets are met.

9. Inspector of Income Tax

- Conducts verification, surveys, and data collection.

- Assists ITOs during raids and on-site investigations.

10. Tax Assistant / Executive Assistant

- Handles data entry, documentation, and file management.

- Supports assessing officers in administrative tasks.

11. Clerical and Support Staff

- Maintain office records, assist in correspondence, and perform logistical work.

Section 5: Recruitment Process for Officers

(A) Through UPSC Civil Services Examination (CSE)

- Recruits candidates into the Indian Revenue Service (IRS – Income Tax).

- The entry-level post is Assistant Commissioner of Income Tax (ACIT).

- The career path continues up to Chairman, CBDT.

(B) Through SSC Combined Graduate Level (CGL) Exam

- Recruits candidates as Income Tax Inspectors.

- With promotions, they can reach up to Principal Chief Commissioner level in some cases.

(C) Through Departmental Exams

- Departmental staff can appear for internal exams to rise to higher positions (e.g., Inspector to ITO).

Section 6: Pay Scales and Salary Levels (7th Pay Commission)

| Post | Pay Level | Approx. Salary (₹) |

|---|---|---|

| Chairman, CBDT | Apex Scale | ₹2,25,000 (fixed) |

| Member, CBDT | Apex Scale | ₹2,25,000 (fixed) |

| Pr. CCIT | Level 17 | ₹2,05,400 – ₹2,24,400 |

| CCIT | Level 16 | ₹1,82,200 – ₹2,24,100 |

| Pr. CIT / CIT | Level 15 | ₹1,44,200 – ₹2,18,200 |

| Addl. CIT / JCIT | Level 13A | ₹1,31,100 – ₹2,16,600 |

| DCIT / ACIT | Level 10–11 | ₹56,100 – ₹2,08,700 |

| Income Tax Officer | Level 7 | ₹44,900 – ₹1,42,400 |

| Inspector | Level 6 | ₹35,400 – ₹1,12,400 |

| Tax Assistant | Level 4 | ₹25,500 – ₹81,100 |

| MTS / Clerk | Level 2 | ₹19,900 – ₹63,200 |

Section 7: Zonal Structure of the Income Tax Department

The entire Income Tax Department is divided into 18 regional zones in India, each headed by a Principal Chief Commissioner of Income Tax (Pr. CCIT).

Some of the major zones include:

- Delhi Region

- Mumbai Region

- Chennai Region

- Kolkata Region

- Ahmedabad Region

- Hyderabad Region

- Pune Region

- Bengaluru Region

- Lucknow Region

- Bhopal Region

Each region is further divided into field formations (circles and wards), which handle assessments and enforcement.

Section 8: How to Access the Actual Income Tax Officer List (Official Website)

If you are looking for the official Income Tax Department officer list (by name) for any region, it is available on the official ITD website.

Follow these steps:

- Visit https://incometaxindia.gov.in.

- Go to the ‘About Us’ or ‘Directory’ section.

- Choose your region (e.g., Delhi, Mumbai, Chennai).

- You’ll find PDFs or pages listing:

- Names of Commissioners

- Contact details of officers

- Office addresses and jurisdiction details

This list is regularly updated by the department for transparency and communication.

Section 9: Career Growth and Promotion Path

Here’s how an officer typically moves upward in the hierarchy:

For IRS Officers (UPSC Route):

ACIT → DCIT → JCIT → Addl. CIT → CIT → Pr. CIT → CCIT → Pr. CCIT → Member/Chairman, CBDT.

For SSC CGL Recruits:

Inspector → Income Tax Officer → ACIT (through promotion) → DCIT → and so on.

Hence, the officer list not only shows ranks but also represents a career ladder that stretches from entry-level to apex-level posts.

Section 10: Significance of the Officer List

The officer list is not just a directory — it represents the backbone of India’s revenue collection system. Every rank, from an inspector in a district office to the Chairman of CBDT, plays a role in ensuring the nation’s economy runs smoothly.

The officer hierarchy ensures:

- Accountability: Clear reporting and supervision.

- Efficiency: Delegation of specialized tasks.

- Transparency: Public availability of officer details.

- Professional Growth: Structured promotions and training.

Also Read:

- Income tax officer eligibility for female

- How to become a income tax officer after 12th

- Income tax officer exam syllabus

- Yuzvendra chahal income tax officer

- Income tax officer age limit

- Facilities of income tax officer

- Income tax officer qualification

- Income tax officer car

Conclusion

The Income Tax Department Officer List reflects the structured and powerful framework that governs India’s direct taxation system. Starting from entry-level inspectors recruited through SSC to top IRS officers appointed through UPSC, every post in this hierarchy contributes to maintaining fiscal discipline and ensuring tax compliance across the nation.

This system is not just about hierarchy — it represents the career growth, responsibility, and prestige associated with being part of India’s revenue administration.

Whether you are an aspirant preparing for SSC CGL or UPSC, or simply curious about how the Income Tax Department operates, understanding this officer list gives a clear picture of how India’s tax machinery functions — from the ground up to the topmost policy-making level.