Becoming an Income Tax Officer (ITO) is one of the most sought-after goals for aspirants who dream of serving the nation while enjoying a secure and prestigious career.

The position not only comes with responsibility but also offers respect, authority, and a chance to make an impact on society.

However, before stepping into this career path, one of the most important factors every aspirant must know is the age limit for becoming an Income Tax Officer.

In this article, we will cover the detailed age criteria, category-wise relaxations, and how anyone can draw inspiration from the journey of an Income Tax Officer to achieve their own dreams.

Table of Contents

Age Limit for Income Tax Officer

The recruitment for Income Tax Officers is conducted by the Staff Selection Commission (SSC) through the Combined Graduate Level (CGL) Examination.

The age criteria are carefully set to ensure that candidates are physically, mentally, and academically prepared for the role.

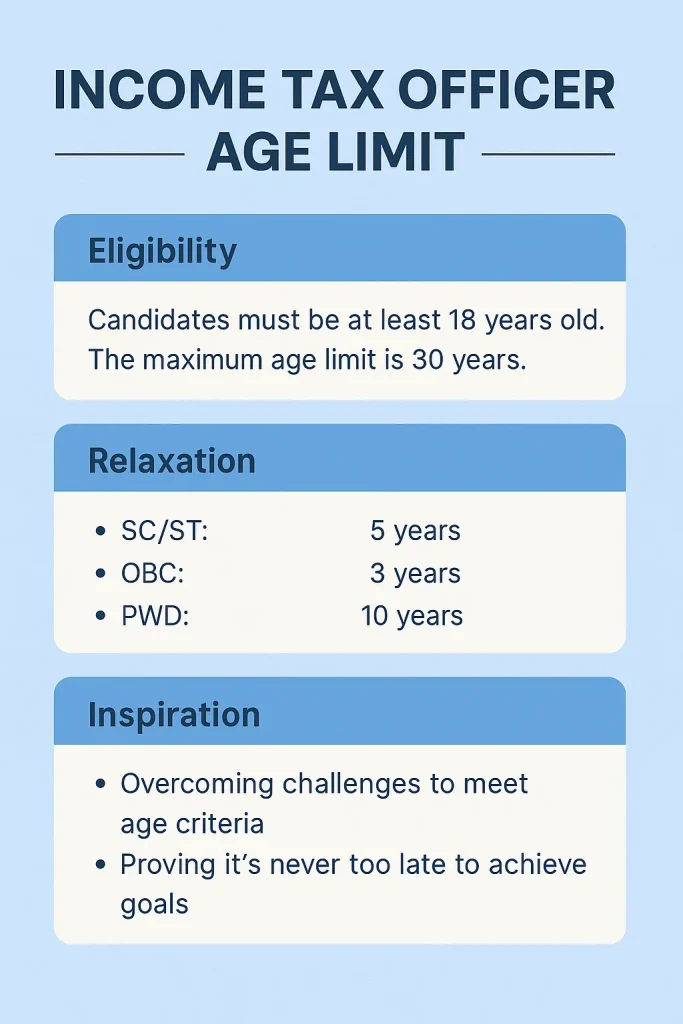

General Age Limit

- Minimum Age: 18 years

- Maximum Age: 30 years

This means that any candidate who falls within this age bracket is eligible to apply, provided they meet the educational and nationality requirements.

Category-Wise Age Relaxation

The Government of India provides age relaxations for candidates belonging to specific categories. This ensures equal opportunity and representation for all sections of society.

- OBC (Other Backward Classes): +3 years (maximum age becomes 33 years)

- SC/ST (Scheduled Castes/Scheduled Tribes): +5 years (maximum age becomes 35 years)

- PwD (Persons with Disabilities):

- PwD (General): +10 years

- PwD (OBC): +13 years

- PwD (SC/ST): +15 years

- Ex-Servicemen: 3 years after deduction of military service from the actual age

- Defense Personnel Disabled in Operations: +5 years (General) and +8 years (SC/ST)

- Other Government Employees (who have worked for more than 3 years in regular service): Up to 40 years

Why the Age Limit Matters?

The age limit ensures fairness in the recruitment process. It allows young aspirants to compete with equal chances while also giving relaxation to underprivileged and special categories. It creates a balance between energy, experience, and inclusiveness in government service.

Also Read:

- Income Tax Officer Eligibility for Female in India

- Yuzvendra Chahal Income Tax Officer Claim Explained

- How to become a income tax officer after 12th?

- Income tax officer qualification

How to Prepare as per Your Age

Since the SSC CGL Exam requires a combination of aptitude, reasoning, English, and general awareness, preparation strategy varies depending on when you start:

- At 18–22 years (early stage): You have more time to prepare. Focus on building strong fundamentals and practicing mock tests.

- At 23–26 years (middle stage): Time management is key. Along with preparation, focus on revision and past-year papers.

- At 27–30 years (upper limit stage): Consistency and discipline are crucial. Since attempts are limited, smart preparation strategies and selective study become very important.

Inspiration from an Income Tax Officer’s Journey

Every Income Tax Officer has a story of hard work, discipline, and perseverance. Many aspirants start with limited resources but achieve success because of their dedication and willpower.

- From Ordinary to Extraordinary: Many officers come from small towns, where access to resources is limited. Yet, they prove that with determination, one can overcome every barrier.

- Age as Just a Number: Some aspirants succeed in their last eligible attempt. This shows that as long as you remain committed, age should not discourage you.

- Service to the Nation: Beyond the exam, an Income Tax Officer plays a critical role in maintaining India’s economy by ensuring tax compliance and curbing corruption. Their dedication can inspire anyone to lead a life of honesty and responsibility.

Also Read:

- What is the work of income tax officer?

- Income tax officer promotion

- Income tax department officer list

- Income tax officer car

What You Can Learn from an Income Tax Officer

Even if you are not preparing for the SSC CGL or aiming to become an Income Tax Officer, you can still take valuable lessons from their journey:

- Discipline – Regular study schedules and perseverance help them clear one of the toughest exams.

- Resilience – Failures in initial attempts don’t stop them; instead, they bounce back stronger.

- Dedication – They dedicate years of preparation to achieve their goal, teaching us the importance of focus in life.

- Service Mindset – Their role reminds us that true success lies in contributing to society and nation-building.

Final Thoughts

The Income Tax Officer age limit is an important factor that every aspirant must check before starting their preparation. With a general age limit of 18–30 years and relaxations for reserved categories, it ensures fair opportunities for all.

But beyond age and eligibility, the journey of becoming an Income Tax Officer is a story of discipline, consistency, and self-belief. Their determination inspires us to never give up, regardless of the challenges life throws at us.

So whether you aspire to become an Income Tax Officer or not, remember: Success is not about where you start, but about how much effort you put in and how committed you remain to your goal.