Becoming an Income Tax Officer (ITO) is one of the most prestigious achievements for those preparing for government jobs in India.

Along with a handsome salary and authority, this position comes with several perks and privileges, one of which frequently draws curiosity — the car facility.

So, what car does an Income Tax Officer get? Is it provided by the government? Does it come with a driver, fuel, or maintenance benefits?

And how do car facilities differ between officers at different levels, from Income Tax Inspectors to Commissioners?

In this article, we’ll cover everything you need to know about Income Tax Officer cars, including:

- Whether Income Tax Officers get official cars

- The type of cars allotted

- Car allowance and fuel limits

- Vehicles used during raids and inspections

- Differences between IRS and non-IRS officers

- Facilities available after promotions

Table of Contents

1. The Role of an Income Tax Officer

An Income Tax Officer (ITO) is a Group B Gazetted Officer working under the Central Board of Direct Taxes (CBDT), which functions under the Ministry of Finance.

Their job involves:

- Assessing income tax returns

- Conducting raids and surveys

- Monitoring tax evasion

- Managing income tax offices and staff

Because of the sensitive nature of their work — which often requires field visits, surveillance, and inspections — vehicles become essential for mobility, security, and efficiency.

2. Do Income Tax Officers Get a Car?

The short answer is — Yes, Income Tax Officers do get car facilities, but the type of car and the nature of the benefit depends on their rank, post, and duties.

Let’s understand this in detail.

(A) Car Facility for Income Tax Officers (Group B)

Income Tax Officers (ITOs) are gazetted officers, but not all of them get an official vehicle for daily use.

The facility varies depending on whether the officer is:

- Posted in a field job (like investigation, survey, or enforcement), or

- Posted in an office/administrative position (desk-based).

1. For Field Officers (Investigation / Search & Seizure)

- They get access to government vehicles for official work such as surveys, search operations, or transport of seized materials.

- These cars are usually departmental vehicles, not personal cars.

- Vehicles are shared within the Investigation Wing or Range.

2. For Administrative Officers

- If posted in an office setting (non-field), the ITO may not get a dedicated car, but can avail transport allowance (TA) every month.

(B) Type of Cars Used by Income Tax Officers

The Income Tax Department uses vehicles that are economical, reliable, and suited for official duty. These are not luxury cars but practical sedans or SUVs.

Some common vehicles used by ITOs and other officers include:

- Maruti Suzuki Dzire / Ciaz – for administrative use

- Toyota Innova / Innova Crysta – for raids and team movement

- Mahindra Bolero / Scorpio – for field operations

- Tata Safari / Tata Harrier – occasionally for higher officials

- Ambassador (formerly used) – phased out but iconic in tax offices

These cars are maintained by the department and are not personally owned by the officer.

(C) Car Facility During Raids

When the department conducts search and seizure operations (raids), special vehicles are used:

- Usually SUVs or MUVs (Innova, Bolero, Scorpio) to accommodate officers, drivers, and equipment.

- These are official vehicles from the department’s pool, assigned temporarily.

- Officers may also travel with local police for security.

So, while an ITO may not have a personal government car every day, during field duties and raids, vehicle support is always provided.

3. Car Facility for Senior Income Tax Officers (IRS Officers)

Once an officer is promoted to the Indian Revenue Service (IRS – Income Tax) cadre, the car facility becomes permanent and official.

Let’s see how it changes with ranks.

(A) Assistant Commissioner of Income Tax (ACIT)

- This is the entry-level IRS post (Group A) after promotion from ITO or through UPSC Civil Services Exam.

- ACITs get a dedicated official car for official duties.

- Usually mid-segment sedans like Maruti Ciaz or Hyundai Verna are allotted.

- A driver (chauffeur) is also provided.

- Fuel and maintenance are fully covered by the government.

(B) Deputy Commissioner of Income Tax (DCIT)

- Gets upgraded car models.

- Official cars include Toyota Innova, Ciaz, or Honda City, depending on posting city and department allocation.

- A driver, official fuel quota, and vehicle maintenance are provided.

- The officer can also use the car for limited personal use under government rules.

(C) Joint Commissioner / Additional Commissioner of Income Tax (JCIT / Addl. CIT)

- Gets higher-segment vehicles like Toyota Innova Crysta or premium sedans.

- Assigned exclusive government vehicles with drivers.

- These cars are maintained through the department’s vehicle budget.

(D) Commissioner & Above

From Commissioner of Income Tax (CIT) level onward, the officer becomes part of senior administration.

They are entitled to official vehicles round the clock.

Typical vehicles include:

- Toyota Innova Crysta

- Hyundai Tucson

- Skoda Superb / Toyota Camry (for Principal Commissioners)

- Luxury sedans / SUVs (for Chief Commissioners)

They have dedicated chauffeurs, official maintenance, and fuel coverage.

4. Transport Allowance for Income Tax Officers

When an officer doesn’t get an official car, they receive Transport Allowance (TA) in their salary.

Transport Allowance (7th Pay Commission)

- For Income Tax Officer (Pay Level 7): ₹3,600 to ₹7,200 per month (based on city class).

- For Inspectors and Assistants (Level 6): ₹3,600 + DA.

- For IRS Officers (Group A): ₹7,200 to ₹15,750 + DA (varies by grade and posting city).

This allowance covers personal transport costs when an official car isn’t allotted.

5. Car Facility During Field Inspections and Official Travel

Income Tax Officers frequently go on:

- Surveys and searches (raids)

- Assessment visits

- Verification of records at business premises

- Coordination with enforcement agencies

During these duties:

- Departmental cars are mandatorily provided for safety and logistics.

- Officers may travel with a driver, team of inspectors, and sometimes armed police personnel.

- Fuel, vehicle, and security arrangements are handled by the Income Tax Department’s logistics branch.

This ensures smooth operations, as officers deal with sensitive financial matters.

6. Car Maintenance and Fuel Policy

Official vehicles are maintained by the department. Here’s how the system works:

(A) Vehicle Ownership

All vehicles belong to the Central Government (CBDT), not individual officers.

When an officer gets transferred, the car remains with the office.

(B) Fuel Policy

- Officers with official cars get a monthly fuel quota based on their post.

- Higher ranks (Commissioners) may get unlimited fuel for official use.

- For personal use (if permitted), additional fuel cost is deducted or adjusted.

(C) Maintenance

- Repairs and servicing are handled by the department.

- Drivers are provided and paid by the government.

This setup allows officers to perform their duties without worrying about vehicle management.

7. Difference Between IRS and SSC Recruited Officers in Car Facilities

| Aspect | Income Tax Officer (SSC Route) | IRS Officer (UPSC Route) |

|---|---|---|

| Post Level | Group B Gazetted | Group A (IRS) |

| Entry Method | SSC CGL Exam | UPSC Civil Services Exam |

| Car Facility | Provided during raids or shared field use | Dedicated official car with driver |

| Fuel & Maintenance | Department-provided for duty | Fully paid by government |

| Driver | Shared / Pool-based | Personal (official driver) |

| Type of Car | Sedan / SUV (temporary) | Sedan / Premium SUV |

| Car Use | Field duty only | Official + Limited personal use |

So, while SSC recruits (Income Tax Officers) do get vehicle support for official tasks, IRS officers enjoy permanent, higher-grade car privileges as part of their service.

8. Car Facility During Promotions

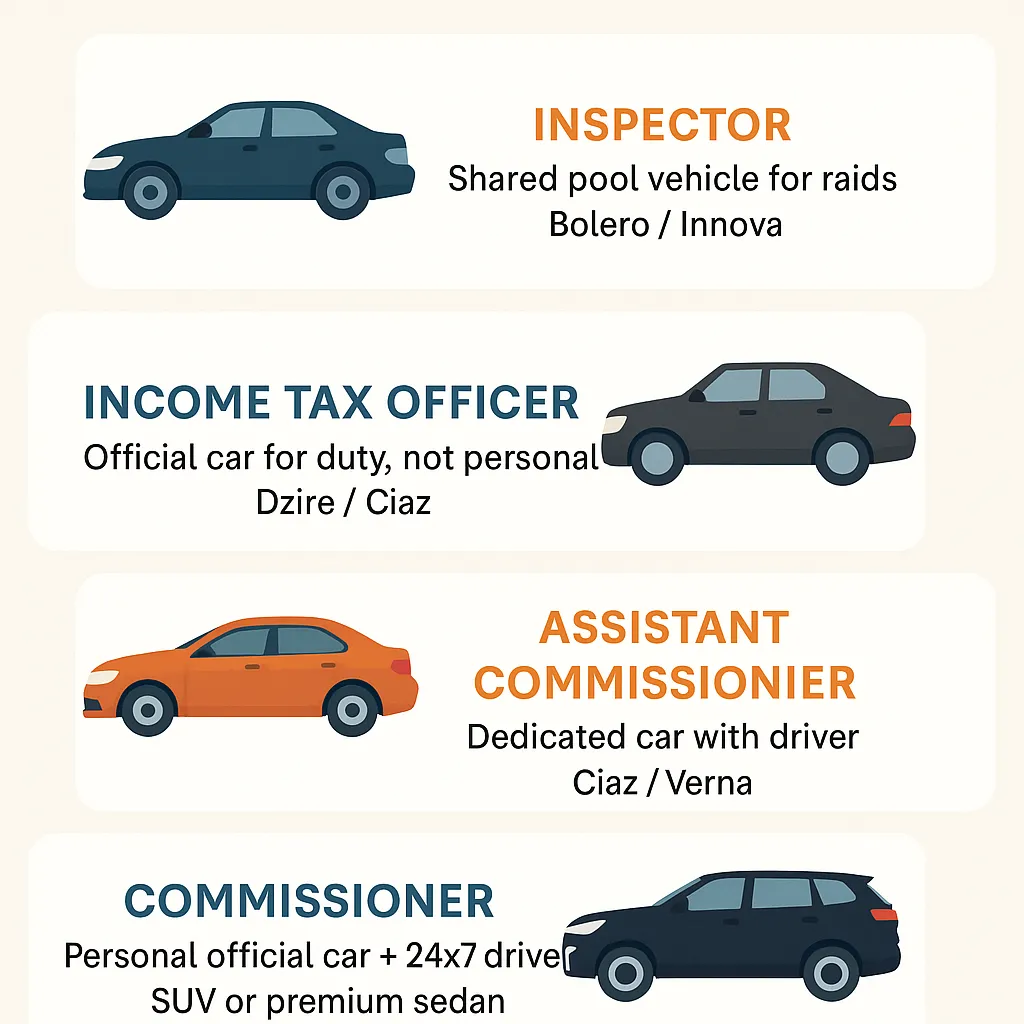

As officers rise through ranks, car facilities improve.

| Rank | Car Facility | Type of Vehicle |

|---|---|---|

| Inspector | Shared pool vehicle for raids | Bolero / Innova |

| Income Tax Officer | Official car for duty, not personal | Dzire / Ciaz |

| Assistant Commissioner | Dedicated car with driver | Ciaz / Verna |

| Deputy Commissioner | Car + driver + fuel allowance | Innova / City |

| Joint Commissioner | High-end car + driver + unlimited fuel | Innova Crysta |

| Commissioner | Personal official car + 24×7 driver | SUV or premium sedan |

| Principal Commissioner | Flag car, personal driver | Camry / Superb |

| Chief Commissioner | High-end SUV with escort vehicle | Toyota Fortuner / similar |

By the time an officer reaches the Commissioner level, they enjoy full-fledged VIP car facilities — comparable to senior IAS and IPS officers.

9. Cars Used During High-Profile Raids

During high-profile raids involving corporate houses, film industries, or real estate investigations, the department often deploys a fleet of vehicles for safety and coordination.

- Cars used: Toyota Innova, Mahindra Scorpio, Tata Safari, Maruti Ertiga.

- Vehicles are usually unmarked (no government emblem) to maintain confidentiality.

- Officers also carry wireless communication equipment during operations.

- Some vehicles are leased for temporary operations to avoid public suspicion.

Thus, the “Income Tax Officer car” also symbolizes the power and mobility of the department during such raids.

10. Life Inside the Car: Stories from the Field

Many officers recount that the department vehicle becomes their second office.

During raid operations:

- Officers travel overnight to multiple cities.

- Files, laptops, and evidence materials are loaded in the car.

- Communication and strategy meetings happen inside the vehicle.

For most ITOs, the car represents mobility, duty, and authority — not just a perk.

11. Car Facility After Retirement

Official cars are withdrawn after retirement.

However, retired senior officers (Commissioners and above) often receive honorary transport assistance or allowances during special assignments, committee roles, or consultancy positions with CBDT.

12. Key Points Summary

- Income Tax Officers get car access for official duties (especially fieldwork).

- IRS officers (from ACIT onwards) get dedicated official cars with drivers.

- Fuel, maintenance, and driver salary are covered by the department.

- Transport allowance is given if no official car is allotted.

- Car type and privileges improve with promotion — from Dzire to Camry.

- Vehicles are used extensively during raids, surveys, and investigations.

- Higher-level officers enjoy 24×7 personal car use as part of their entitlement.

Also Read:

- Income tax officer eligibility for female

- How to become a income tax officer after 12th

- Income tax officer exam syllabus

- Yuzvendra Chahal as an income tax officer

- Income tax officer age limit

- Income tax department officer list

Conclusion

The Income Tax Officer car is more than just a vehicle — it’s a symbol of responsibility, authority, and efficiency.

While new officers at the Income Tax Officer level usually share cars for official purposes, senior officers in the Indian Revenue Service are entitled to dedicated, chauffeur-driven government vehicles with full maintenance and fuel facilities.

These car facilities not only ensure smooth execution of duties but also reflect the prestige and administrative importance of the post.

From the humble Maruti Dzire used during field inspections to the Toyota Camry of Chief Commissioners — every vehicle carries the emblem of duty, discipline, and national service.

For aspirants dreaming of this career, the official car is not just a perk — it’s a reminder of the responsibility that comes with power.