The Income Tax Officer (ITO) post in India is one of the most prestigious and respected government jobs.

With increasing representation of women in civil services, many aspirants wonder if there are any specific eligibility criteria for females who wish to become Income Tax Officers.

The answer is simple: the eligibility is the same for both men and women. But beyond eligibility, the career journey, work-life balance, and the inspirational stories of women who have cracked this exam make this path unique.

In this article, we’ll explore every detail about the eligibility of females for the Income Tax Officer post, the exam process, preparation strategy, challenges, opportunities, and how anyone—male or female—can take inspiration from the determination required to reach this position.

Table of Contents

1. Who is an Income Tax Officer?

An Income Tax Officer is a Group B Gazetted Officer under the Central Board of Direct Taxes (CBDT), a part of the Department of Revenue in the Ministry of Finance, Government of India.

The primary role of an ITO is to ensure compliance with direct tax laws, conduct surveys and raids (if required), and monitor tax collections.

It is a career filled with:

- Power and authority – ITOs have the legal right to investigate tax evasion.

- Stability – Job security and regular promotions make this a stable career.

- Respect – As guardians of financial discipline, ITOs enjoy social prestige.

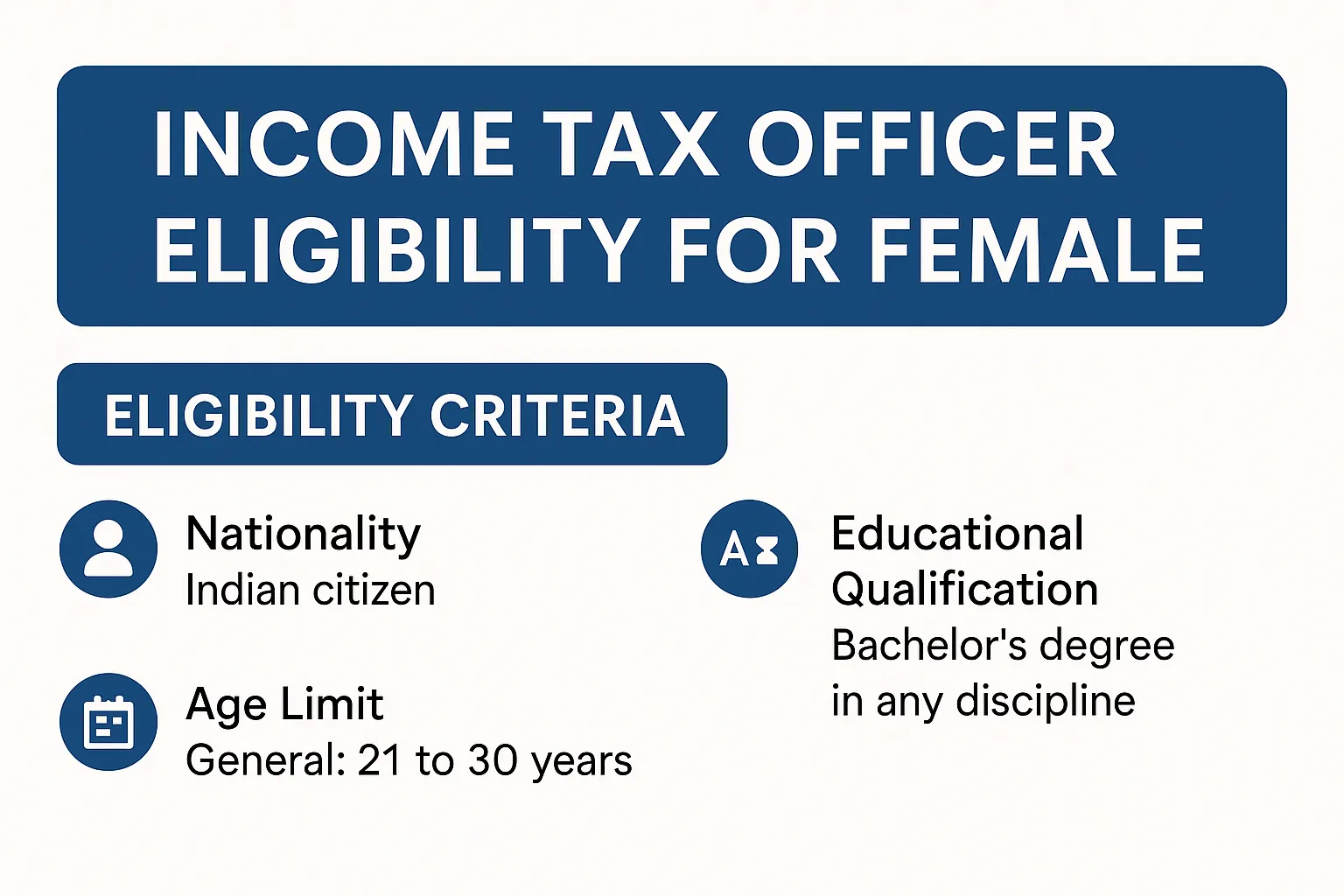

2. Income Tax Officer Eligibility for Female

a) Nationality

- The candidate must be an Indian citizen.

- Certain categories like subjects of Nepal, Bhutan, or Tibetan refugees (before Jan 1, 1962) may also apply, but the majority of candidates are Indian citizens.

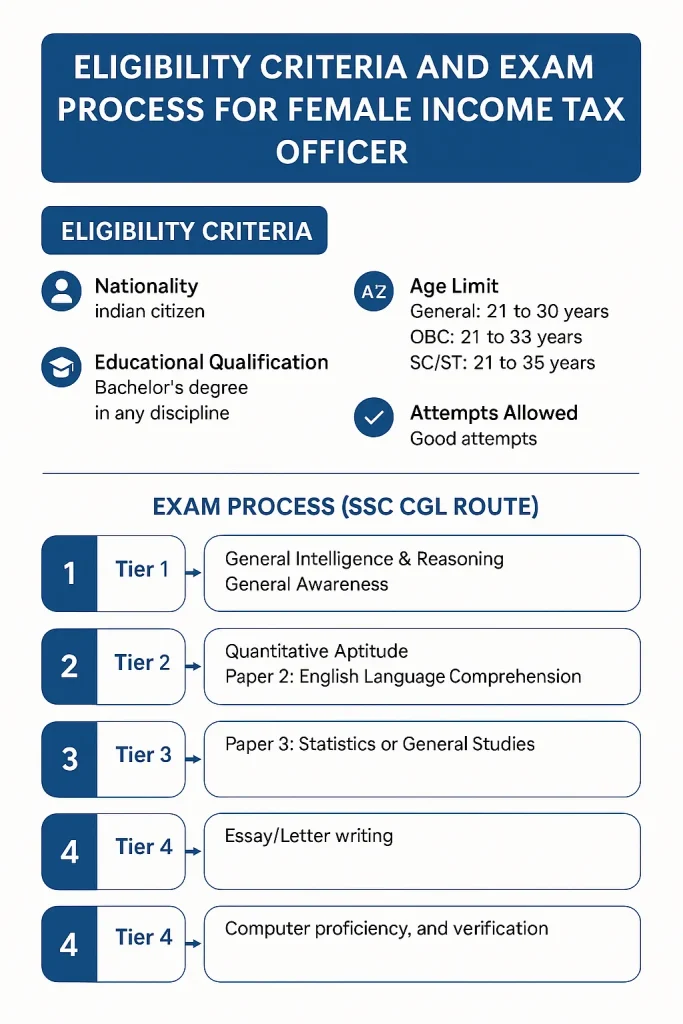

b) Educational Qualification

- A Bachelor’s degree in any discipline from a recognized university is mandatory.

- There is no restriction on subject choice—whether you studied arts, commerce, science, law, or engineering, you are eligible.

- Final year students awaiting results can also apply provisionally.

c) Age Limit

- General category: 21 to 30 years

- OBC: 21 to 33 years (3-year relaxation)

- SC/ST: 21 to 35 years (5-year relaxation)

- Persons with Benchmark Disability (PwBD): additional 10 years relaxation.

For female candidates, there are no special age relaxations beyond these standard rules.

d) Number of Attempts (for UPSC route)

- General: 6 attempts

- OBC: 9 attempts

- SC/ST: Unlimited attempts till age limit

e) Physical Fitness

Some roles in the Income Tax Department require basic physical standards, especially if assigned to field duties.

- Good mental and physical health is mandatory.

- There are no separate standards for females—medical fitness is evaluated equally.

f) Marital Status

Marital status (married/unmarried) does not affect eligibility. Many female officers join the service post-marriage as well.

3. How to Become an Income Tax Officer?

There are two main routes:

Route 1: Through UPSC Civil Services Examination (CSE)

- Conducted by the Union Public Service Commission (UPSC).

- If you secure a good rank, you may be allotted the Indian Revenue Service (IRS – Income Tax).

- IRS officers are senior to ITOs, but both work under the same department.

Route 2: Through SSC CGL (Staff Selection Commission – Combined Graduate Level Exam)

- This is the direct recruitment route to become an Income Tax Officer.

- Conducted annually by SSC for graduate candidates.

- The ITO post falls under Grade B (Non-Gazetted initially, later promoted to Gazetted).

4. Exam Pattern for SSC CGL (Income Tax Officer Post)

Tier 1 (Prelims – Online)

- General Intelligence & Reasoning – 25 Qs

- General Awareness – 25 Qs

- Quantitative Aptitude – 25 Qs

- English Comprehension – 25 Qs

- Total: 200 Marks, 60 minutes

Tier 2 (Mains – Online)

- Paper 1: Quantitative Aptitude

- Paper 2: English Language & Comprehension

- Paper 3: Statistics (optional for some posts)

- Paper 4: General Studies (Finance & Economics)

Tier 3 (Descriptive – Offline)

- Essay/Letter writing in English/Hindi.

Tier 4 (Skill Test/Interview/Document Verification)

- Computer proficiency and verification of eligibility.

Once you clear these stages, you undergo training at the National Academy of Direct Taxes (NADT), Nagpur.

- How to become a income tax officer after 12th?

- What is the work of income tax officer?

- Income tax department officer list

- Income tax officer car

5. Why More Women Are Becoming Income Tax Officers

Over the years, more women have joined the Income Tax Department. The reasons include:

- Equal eligibility – No gender-based restrictions.

- Job security – A government career is ideal for women seeking stability.

- Authority and respect – Female ITOs break stereotypes by excelling in leadership roles.

- Inspiration – Women like IRS officer Smita Sabharwal (though from IAS, often compared) have become role models for many aspirants.

6. Challenges Female Candidates May Face

Although the eligibility criteria are equal, the journey may feel tougher for women due to societal and personal factors:

- Balancing preparation with family expectations.

- Safety concerns during postings in certain areas.

- Stereotypes that question a woman’s authority in enforcement roles like raids.

But these challenges have not stopped determined women from cracking the exam and proving themselves.

7. Benefits of Becoming an Income Tax Officer for Women

- Financial independence – Salaries, allowances, and perks provide stability.

- Empowerment – Being in an enforcement role strengthens women’s leadership presence.

- Career growth – Promotions can lead to Assistant Commissioner, Deputy Commissioner, and beyond.

- Work-life balance – While demanding, the job offers structured timings compared to private sector roles.

8. Preparation Strategy for Female Aspirants

- Step 1: Build a Strong Foundation

Start with NCERTs (6th–12th) for General Studies. - Step 2: Choose Your Resources Wisely

- Lucent’s GK for General Awareness

- Quantitative Aptitude by R.S. Aggarwal

- English Grammar by Wren & Martin

- Step 3: Practice Mock Tests

Regular online tests help improve speed and accuracy. - Step 4: Time Management

Women managing household responsibilities should create a structured timetable. - Step 5: Motivation and Peer Support

Join study groups or online communities for guidance and motivation.

9. Inspirational Angle: Learning from the Journey of an Income Tax Officer

Becoming an ITO is not just about eligibility—it’s about dedication, patience, and consistency.

Think of it this way:

- An aspirant may start from a small town with limited resources.

- They may face societal pressure—“Why do you want such a tough job?”

- They may struggle financially while preparing.

- Yet, with resilience, they crack one of India’s toughest exams and rise to a position of power and respect.

This journey itself is an inspiration for everyone—male or female.

Life Lessons from an Income Tax Officer’s Journey:

- Perseverance pays off – Success may take years, but patience leads to results.

- Equality through merit – Exams like SSC CGL and UPSC don’t see gender, only effort.

- Service before self – The role teaches discipline and responsibility towards the nation.

10. How Anyone Can Take Inspiration

Even if you are not preparing for this exam, you can learn from an ITO’s journey:

- For students – Stay focused on your studies and goals.

- For professionals – Consistency and honesty in work bring long-term success.

- For homemakers – It’s never too late to restart a career or dream big.

- For society – Respect women breaking barriers in every field.

11. Salary, Perks, and Career Growth

- Starting salary: ₹44,900 – ₹1,42,400 (as per 7th CPC, Level 7).

- Allowances: HRA, DA, TA, medical, pension, etc.

- Perks: Official car, staff support, accommodation (in some postings).

- Growth:

- Income Tax Officer → Assistant Commissioner → Deputy Commissioner → Joint Commissioner → Additional Commissioner → Commissioner of Income Tax → Principal Commissioner.

Did yiu know UV Chahal also was income tax officer?

12. Conclusion

The eligibility criteria for females to become an Income Tax Officer are exactly the same as for males.

What matters most is dedication, preparation, and resilience. Women are excelling in this field, balancing personal and professional responsibilities, and inspiring the next generation of aspirants.

Whether you are a student from a rural background or an urban aspirant with resources, the lesson is the same: with patience and persistence, dreams turn into reality.

Becoming an Income Tax Officer is not just about clearing an exam—it’s about proving that with determination, gender doesn’t matter; only merit does.