Becoming an Income Tax Officer (ITO) in India is one of the most respected and rewarding career paths for graduates aspiring to join the government sector.

The Income Tax Department, under the Central Board of Direct Taxes (CBDT), recruits officers primarily through the Staff Selection Commission (SSC) Combined Graduate Level (CGL) Examination.

If you are preparing for this exam, understanding the syllabus in detail is your first and most important step.

Many aspirants jump into preparation without clearly knowing the exam pattern and subject weightage.

This guide will help you master the Income Tax Officer Exam Syllabus with in-depth subject breakdowns, strategy tips, and insights based on the real preparation journey of successful candidates.

Table of Contents

1. Overview of Income Tax Officer Recruitment

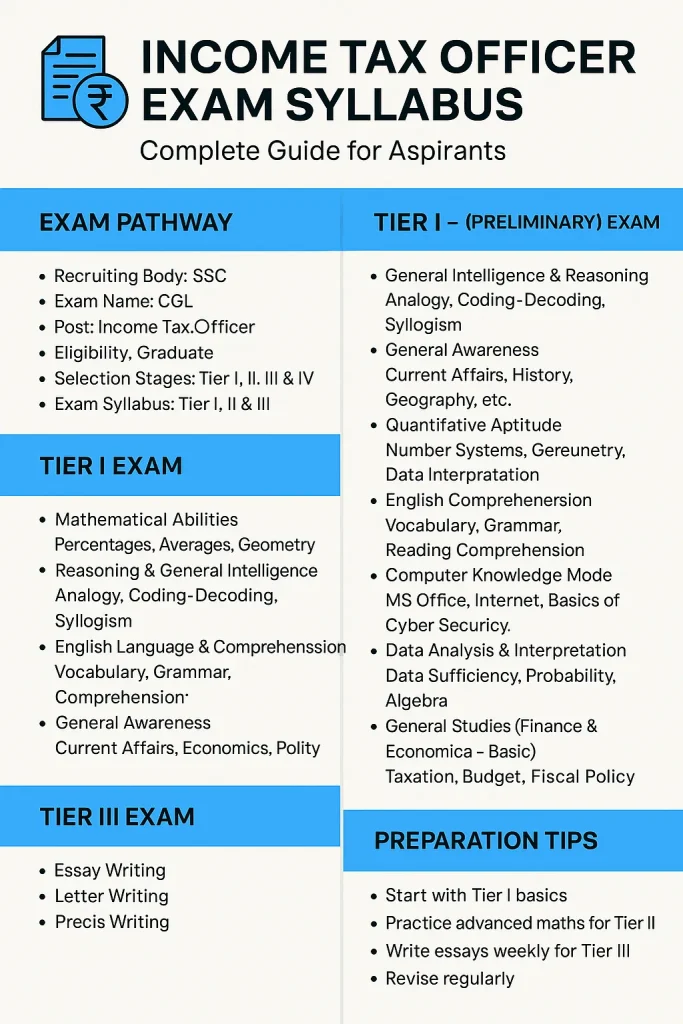

Before diving into the syllabus, let’s first understand the exam pathway:

- Recruiting Body: Staff Selection Commission (SSC)

- Exam Name: Combined Graduate Level (CGL) Examination

- Post: Income Tax Inspector / Officer (promoted later as ITO) under CBDT

- Eligibility: Graduate in any stream, Age limit 18–30 years (with relaxation for reserved categories)

- Selection Stages:

- Tier I – Computer Based Test (Objective, Qualifying)

- Tier II – Computer Based Test (Objective, Merit-Deciding)

- Tier III – Descriptive Paper (in English/Hindi)

- Tier IV – Computer Skill Test / Document Verification

The syllabus is spread across Tier I, II, and III, while Tier IV is more about skill verification.

2. Detailed Income Tax Officer Exam Syllabus

2.1 SSC CGL Tier I (Preliminary Examination) – Objective CBT

The Tier I exam is qualifying in nature but highly competitive. Scoring well here is crucial to make it to Tier II.

Exam Pattern (Tier I):

- Duration: 60 minutes

- Questions: 100 (2 marks each, -0.50 negative marking)

- Sections: 4 (25 questions each)

- Total Marks: 200

Syllabus Breakdown:

(A) General Intelligence & Reasoning

- Verbal Reasoning: Analogies, Coding-Decoding, Classification, Series, Blood Relations, Directions, Ranking, Puzzle Test.

- Non-Verbal Reasoning: Mirror Images, Paper Folding, Figure Series, Embedded Figures.

- Logical Reasoning: Syllogisms, Statement & Conclusion, Cause & Effect, Assumptions.

- Practice Tip: Focus on speed-based accuracy, as reasoning is considered a scoring section.

(B) General Awareness

- Current Affairs (last 6–8 months)

- History (Ancient, Medieval, Modern India)

- Geography (Physical + Indian + World)

- Polity (Indian Constitution, Governance, Rights)

- Economics (basic concepts, Indian Economy, Budget, Tax system)

- Science (Physics, Chemistry, Biology – basic level)

- Static GK (important dates, books, awards, institutions)

- Practice Tip: Revise daily through GK capsules + monthly magazines like Yojana, Kurukshetra.

(C) Quantitative Aptitude

- Arithmetic: Profit & Loss, Percentage, Ratio & Proportion, Average, Time & Work, Time & Distance, SI & CI.

- Algebra: Linear & Quadratic Equations.

- Geometry & Mensuration: Triangles, Circles, Trapezium, Cylinder, Cone, Sphere.

- Trigonometry: Heights & Distances, Basic Identities.

- Data Interpretation: Tables, Graphs, Charts.

- Practice Tip: SSC repeats question patterns. Solve past 10-year papers.

(D) English Comprehension

- Vocabulary: Synonyms, Antonyms, Idioms, One-word substitution.

- Grammar: Error spotting, Sentence correction, Fill in the blanks.

- Reading Comprehension & Cloze Test.

- Practice Tip: Read newspapers (The Hindu/Indian Express) daily for comprehension speed.

2.2 SSC CGL Tier II – Objective CBT

Tier II is the most crucial stage for final merit ranking. Since 2022, SSC has restructured Tier II.

Exam Pattern (Tier II):

- Paper I (Compulsory for all posts)

- Sections: Mathematical Ability, Reasoning, English, General Awareness, Computer Proficiency, Data Analysis, and General Studies.

- Paper II (Statistics) – Only for Junior Statistical Officer posts.

- Paper III (Finance & Economics) – Only for AAO (Audit & Accounts).

For Income Tax Officer, only Paper I is mandatory.

Paper I Syllabus Breakdown:

(A) Mathematical Abilities

- Number Systems

- Percentages, Ratio & Proportion

- Averages, Mixture & Allegation

- Speed, Distance, and Time

- Simple & Compound Interest

- Profit & Loss, Discount

- Geometry, Mensuration

- Trigonometry (advanced questions)

- Data Interpretation (Tables, Charts, Graphs, Caselets)

- Probability & Permutation–Combination

(B) Reasoning & General Intelligence

- Verbal Reasoning: Analogy, Coding-Decoding, Syllogism, Logical Venn Diagrams

- Non-Verbal Reasoning: Series, Mirror/Water Images, Figure Classification

- Critical Thinking: Cause-Effect, Course of Action

(C) English Language & Comprehension

- Vocabulary (difficult level)

- Sentence Improvement & Rearrangement

- Error Recognition (Grammar & Usage)

- Cloze Test, Comprehension Passages

- Active–Passive Voice, Direct–Indirect Speech

(D) General Awareness

- Current Affairs (International + National)

- History, Polity, Geography

- Economy (esp. taxation, budget, government schemes)

- Science & Technology

- Environmental issues

(E) Computer Knowledge Module

- Basics of Computers (hardware, software)

- Internet & Email

- MS Office (Word, Excel, PowerPoint basics)

- Cyber Security Basics

(F) Data Analysis & Interpretation

- Data Sufficiency

- Line/Bar/ Pie Graphs

- Probability, Algebra, Trigonometry (advanced)

(G) General Studies (Finance & Economics – Basic)

- Fundamental principles of micro & macroeconomics

- Role of taxation in Indian economy

- Types of taxes (Direct, Indirect, GST, Income Tax basics)

- Budget & Fiscal Policy basics

2.3 SSC CGL Tier III – Descriptive Paper

- Mode: Pen & Paper

- Duration: 60 minutes

- Marks: 100

- Language: English or Hindi

Syllabus:

- Essay Writing (topics like GST, Digital India, Tax Reforms, Indian Economy)

- Letter/Application Writing (official, formal, complaint, representation)

- Precis Writing

Preparation Tip: Practice essays on current economic and social issues. Focus on structured writing (Intro → Body → Conclusion).

2.4 SSC CGL Tier IV – Skill Test/Document Verification

For Income Tax Officer, Tier IV is usually document verification. Some posts require Computer Proficiency Test (CPT) but for ITO, it’s primarily verification of documents and eligibility.

Also Read:

- Income tax officer eligibility for female

- How to become a income tax officer after 12th

- What is the work of income tax officer?

- Income tax officer qualification

- Income tax officer promotion

- Income tax department officer list

- Income tax officer car

- Income tax officer salary

3. How the Syllabus Relates to the Job of an Income Tax Officer

An Income Tax Officer deals with:

- Assessing income tax returns.

- Conducting raids and investigations against tax evasion.

- Preparing reports and audits.

- Ensuring compliance with tax laws.

That’s why the exam syllabus covers reasoning, numerical ability, economics, general knowledge, and English—all skills directly relevant to investigation, reporting, and analysis work in taxation.

4. Preparation Strategy Based on the Syllabus

Here’s how toppers suggest preparing for the ITO exam:

- Start with Tier I basics:

- Focus on NCERT (6th–10th) for GK basics.

- Practice reasoning and maths daily for speed.

- Build vocabulary through daily newspaper reading.

- Move to Tier II depth:

- Practice advanced maths and data interpretation.

- Study Indian Economy basics (Ramesh Singh or NCERT Macroeconomics).

- Give mock tests regularly.

- Essay & Descriptive Prep:

- Write 2–3 essays weekly.

- Focus on neat handwriting and structured presentation.

- Revision Plan:

- Make short notes for GK, formulas for Maths, grammar rules for English.

- Revise weekly.

5. Common Mistakes Aspirants Make While Studying the Syllabus

- Ignoring Tier II depth and focusing only on Tier I.

- Studying without analyzing previous year papers.

- Relying only on coaching notes instead of self-study.

- Not practicing descriptive writing for Tier III.

6. Recommended Books & Resources (Syllabus Wise)

- Quantitative Aptitude: R.S. Aggarwal, Arun Sharma (for DI)

- Reasoning: Lucent Reasoning, SSC previous papers

- English: Plinth to Paramount (Neetu Singh), Wren & Martin Grammar

- General Awareness: Lucent GK, NCERTs, Newspapers (The Hindu/Indian Express)

- Economics: NCERT 11th–12th, Ramesh Singh (Indian Economy)

- Essay/Letter Writing: Arihant SSC Descriptive

7. Final Thoughts

The Income Tax Officer Exam Syllabus is vast but well-defined. It is designed to test your analytical skills, logical thinking, numerical aptitude, general awareness, and writing ability—qualities necessary for serving as an officer in India’s taxation system.

If you cover the syllabus systematically, practice mock tests, and keep yourself updated on current affairs, you will not only crack the SSC CGL but also secure a prestigious career as an Income Tax Officer.