A career in the Income Tax Department of India is one of the most prestigious and rewarding paths for government job aspirants.

Among the various posts, the role of an Income Tax Officer (ITO) stands out as a respected and powerful position.

However, for many aspirants and serving officers, one question is particularly important: What is the promotion path of an Income Tax Officer?

This article provides a comprehensive guide to Income Tax Officer promotion, covering:

- The hierarchy in the Income Tax Department.

- Time-bound promotions and service requirements.

- Departmental examinations for faster promotions.

- Career growth opportunities and perks at each stage.

- Real-life timelines of officers.

By the end, you’ll understand how an ITO’s career can progress into the highest echelons of the Indian Revenue Service (IRS).

Table of Contents

Who is an Income Tax Officer?

An Income Tax Officer is a Group B Gazetted Officer in the Income Tax Department, functioning under the Central Board of Direct Taxes (CBDT), Ministry of Finance. Their primary duties include:

- Assessing income tax returns filed by individuals and organizations.

- Conducting investigations and raids in cases of tax evasion.

- Monitoring compliance with tax laws.

- Preparing reports and recommending penalties.

While this is a prestigious entry point, the real career growth begins with promotions that lead to higher administrative and decision-making roles.

Section 1: Entry Path to Become an Income Tax Officer

Before discussing promotions, let’s understand how one becomes an ITO.

- Through SSC CGL Exam – Most officers enter the Income Tax Department as Income Tax Inspectors via the Staff Selection Commission Combined Graduate Level Examination (SSC CGL).

- Promotion to Income Tax Officer – After serving 3–4 years as Inspector and passing the Departmental Examination, they are promoted to ITO.

- Direct Entry through IRS – Candidates who clear UPSC Civil Services Exam (CSE) and get into Indian Revenue Service (IRS-IT) join at a higher rank as Assistant Commissioner of Income Tax (ACIT).

Thus, for SSC CGL entrants, becoming an ITO itself is a promotion from Inspector. But the career growth does not stop there.

Section 2: Promotion Hierarchy in the Income Tax Department

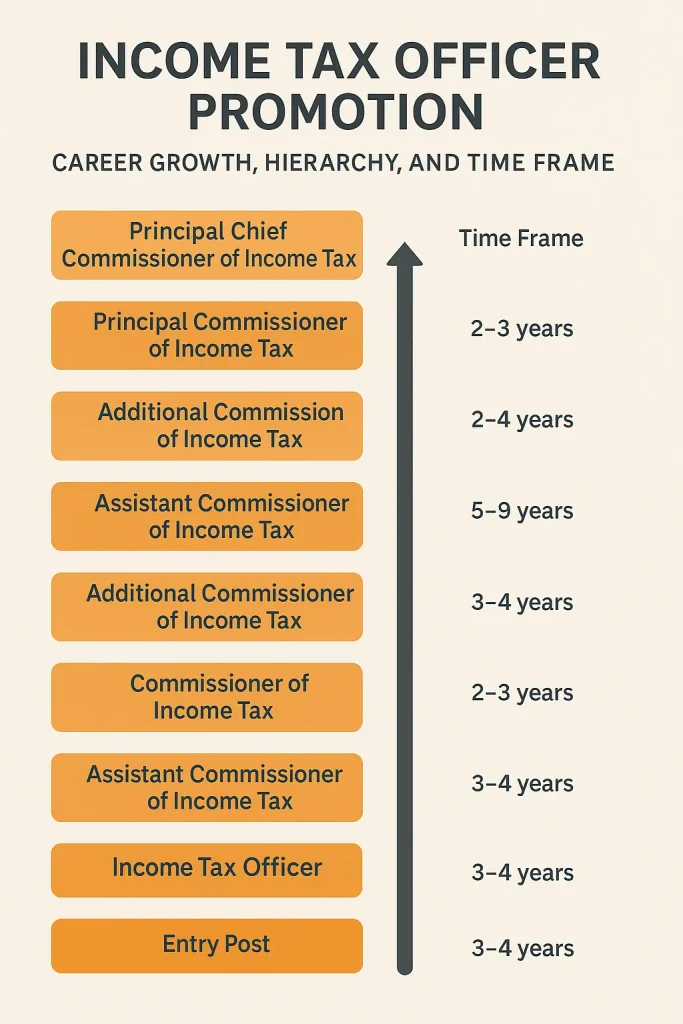

The promotion ladder of an Income Tax Officer typically follows this path:

- Income Tax Inspector (ITI) → via SSC CGL

- Income Tax Officer (ITO) – Group B Gazetted Officer

- Assistant Commissioner of Income Tax (ACIT) – Entry into IRS (Group A)

- Deputy Commissioner of Income Tax (DCIT)

- Joint Commissioner of Income Tax (JCIT)

- Additional Commissioner of Income Tax (Addl. CIT)

- Commissioner of Income Tax (CIT)

- Principal Commissioner of Income Tax (Pr. CIT)

- Chief Commissioner of Income Tax (CCIT)

- Principal Chief Commissioner of Income Tax (Pr. CCIT) – Apex level

At the highest level, ITOs promoted into IRS can even become Member, CBDT or Chairman, CBDT, which is the topmost authority in direct taxation in India.

Section 3: Time Frame for Income Tax Officer Promotion

Promotions in government service are largely based on seniority, service record, departmental exams, and available vacancies.

Step 1: From Inspector to Income Tax Officer

- Time Frame: 3–4 years minimum (with departmental exam) or 6–8 years (without exam).

- Exam Requirement: Departmental Exam conducted by the Income Tax Department.

- Nature of Post: First gazetted post (Group B).

Step 2: From Income Tax Officer to Assistant Commissioner (IRS Entry)

- Normal Route: After ~8–10 years of service as ITO.

- Fast Track Route: Through Departmental Promotion Committee (DPC) recommendations + exam.

- Significance: This marks the shift from Group B to Group A (IRS cadre).

Step 3: Assistant Commissioner to Deputy Commissioner

- Time Frame: 4 years (fixed as per IRS rules).

- Promotion Basis: Time-bound promotion if performance is satisfactory.

Step 4: Deputy Commissioner to Joint Commissioner

- Time Frame: 5 years of service.

- Role: Supervisory responsibilities over multiple ITOs and Inspectors.

Step 5: Joint Commissioner to Additional Commissioner

- Time Frame: 5 years of service.

- Nature: Mid-level management, handling policy and administrative control.

Step 6: Additional Commissioner to Commissioner

- Time Frame: 3–4 years.

- Role: Key decision-making authority over tax circles.

Step 7: Commissioner to Principal Commissioner

- Time Frame: 2–3 years.

- Rank: Equivalent to Joint Secretary in Government of India.

Step 8: Principal Commissioner to Chief Commissioner

- Time Frame: 2–3 years.

- Rank: Equivalent to Additional Secretary in Government of India.

Step 9: Chief Commissioner to Principal Chief Commissioner

- Time Frame: 1–2 years.

- Rank: Equivalent to Secretary in Government of India.

Section 4: Departmental Exams for Faster Promotions

One of the most important aspects of ITO promotion is the Departmental Exam conducted by CBDT.

Nature of Exam:

- Covers Income Tax Law, Accountancy, Procedures, and General Knowledge.

- Tests officers’ ability to handle complex cases.

- Mandatory for promotion from Inspector → ITO and later for higher ranks.

Benefits of Passing Early:

- Officers who clear the exam soon after joining as Inspector often become ITOs within 3–4 years, while others wait 6–8 years.

- This creates a huge difference in career trajectory and pay scale.

Section 5: Pay Scale and Perks at Different Promotion Stages

Promotions not only bring prestige but also higher salary, perks, and facilities.

Income Tax Officer (ITO)

- Pay Level: 7th CPC Pay Matrix Level 7

- Salary: ₹44,900 – ₹1,42,400 (approx. gross ₹70,000–₹80,000 per month).

- Perks: Government quarters, official car, allowances, and field staff.

Assistant Commissioner (ACIT)

- Pay Level: 10 (Group A IRS entry)

- Salary: ₹56,100 – ₹1,77,500 (gross ~₹90,000–₹1 lakh per month).

Deputy Commissioner (DCIT)

- Pay Level: 11

- Salary: ₹67,700 – ₹2,08,700.

Joint Commissioner (JCIT)

- Pay Level: 12

- Salary: ₹78,800 – ₹2,09,200.

Commissioner of Income Tax (CIT)

- Pay Level: 14

- Salary: ₹1,44,200 – ₹2,18,200.

Chief Commissioner of Income Tax (CCIT)

- Pay Level: Apex Scale

- Salary: ₹2,25,000 fixed.

At the highest levels, officers also get staff cars with drivers, government bungalows, and other top-level perks.

Section 6: Career Path Example – Real-Life Timelines

To understand the promotion journey better, let’s look at a sample timeline of an officer who joins as Inspector through SSC CGL at the age of 24.

- Age 24: Joins as Inspector.

- Age 28: Promoted to ITO (after clearing departmental exam quickly).

- Age 36: Promoted to ACIT (entry into IRS).

- Age 40: Promoted to DCIT.

- Age 45: Promoted to JCIT.

- Age 50: Promoted to Addl. CIT.

- Age 53: Promoted to CIT.

- Age 56: Promoted to Pr. CIT.

- Age 58–59: Promoted to CCIT / Pr. CCIT before retirement.

This shows that a fast track officer can reach the highest positions by retirement, provided they clear exams early and maintain a good service record.

Section 7: Challenges in Promotion

While the promotion path looks smooth, aspirants must note some challenges:

- Vacancy Constraints: Promotions depend on the number of available posts.

- Seniority Factor: Even after clearing departmental exams, seniority plays a role.

- Performance Reviews: Poor performance or disciplinary action can delay promotions.

- Competition: Thousands of officers compete for limited higher posts.

Thus, while qualifications and exams are necessary, patience and performance are equally important.

Section 8: Comparison – SSC CGL Route vs UPSC IRS Route

| Aspect | SSC CGL Route (ITO) | UPSC Route (IRS-IT) |

|---|---|---|

| Entry Level | Inspector → ITO | Assistant Commissioner (ACIT) |

| Initial Rank | Group B Gazetted | Group A Officer |

| Time to ACIT | 8–10 years (promotion) | Direct entry |

| Promotions | Slower, depends on exams | Faster, structured IRS promotions |

| Maximum Rank | Pr. CCIT (possible) | CBDT Chairman (possible) |

| Competition | SSC CGL (graduate-level exam) | UPSC Civil Services (highly competitive) |

Thus, while both routes can lead to top ranks, the UPSC IRS route offers faster growth, while the SSC CGL route offers a gradual climb.

Section 9: Strategies to Maximize Promotion Chances

For aspirants and serving officers, here are some tips:

- Clear Departmental Exams early to save years in promotions.

- Maintain fitness and discipline as it reflects in service records.

- Stay updated on tax laws and amendments.

- Network with senior officers and seek mentorship.

- Keep a clean service record – avoid complaints or inquiries.

Section 10: Why Income Tax Officer Promotion is Attractive

Promotions in the Income Tax Department bring more than just money:

- Prestige and Authority – Higher designations mean more respect.

- Decision-Making Power – Senior officers handle policy-making.

- Luxurious Lifestyle – From government houses to official cars.

- National Impact – Officers directly contribute to India’s revenue system.

Also Read:

- Income tax officer eligibility for female

- How to become a income tax officer after 12th

- Income tax officer exam syllabus

- Income tax officer age limit

- Facilities of income tax officer

- Income tax officer qualification?

- What is the Work of an Income Tax Officer?

- Income tax department officer list

- Income tax officer car

Conclusion

The promotion path of an Income Tax Officer is both challenging and rewarding. Starting as an Inspector via SSC CGL, an officer can rise to the topmost levels of the Indian Revenue Service through promotions, departmental exams, and years of service.

- Early career: Inspector → Income Tax Officer.

- Mid-career: ITO → ACIT → DCIT → JCIT.

- Senior career: CIT → Pr. CIT → CCIT → Pr. CCIT.

With the right mix of dedication, performance, and strategic planning, an Income Tax Officer can retire at one of the most powerful positions in India’s tax administration system.

For aspirants, this career offers not just a stable government job, but also a lifetime of growth, respect, and authority.