Becoming an Income Tax Officer (ITO) in India is one of the most respected and sought-after career goals among aspirants preparing for government jobs.

The role not only carries prestige and authority but also offers financial stability, social respect, and a chance to serve the nation.

However, one of the most common questions asked by aspirants is: “What qualifications are required to become an Income Tax Officer?”

In this comprehensive guide, we will cover educational qualifications, eligibility criteria, exams, age limits, and preparation strategies needed to achieve this position.

By the end of this article, you’ll have a clear roadmap for pursuing this career, whether you are a student fresh out of school, a graduate exploring opportunities, or someone already working and considering a switch.

Table of Contents

Who is an Income Tax Officer?

An Income Tax Officer (ITO) works under the Income Tax Department of India, which operates under the Central Board of Direct Taxes (CBDT), Ministry of Finance. Their primary responsibility is to ensure compliance with tax laws, detect tax evasion, assess income tax returns, and conduct raids or investigations where necessary.

This role requires strong analytical skills, legal knowledge, and decision-making ability—all of which begin with meeting the right qualifications to enter the service.

Why Qualification Matters for an Income Tax Officer?

Unlike some professions where experience can outweigh formal education, the path to becoming an Income Tax Officer is strictly regulated. This ensures that only competent and well-prepared individuals handle critical matters of taxation and law enforcement.

- Educational Qualification ensures the candidate has the minimum academic foundation.

- Age & Nationality Requirements ensure fairness and suitability.

- Physical Standards ensure fitness for field duties (especially for raids and inspections).

- Exam Qualification ensures candidates possess the knowledge, aptitude, and skills to manage the role.

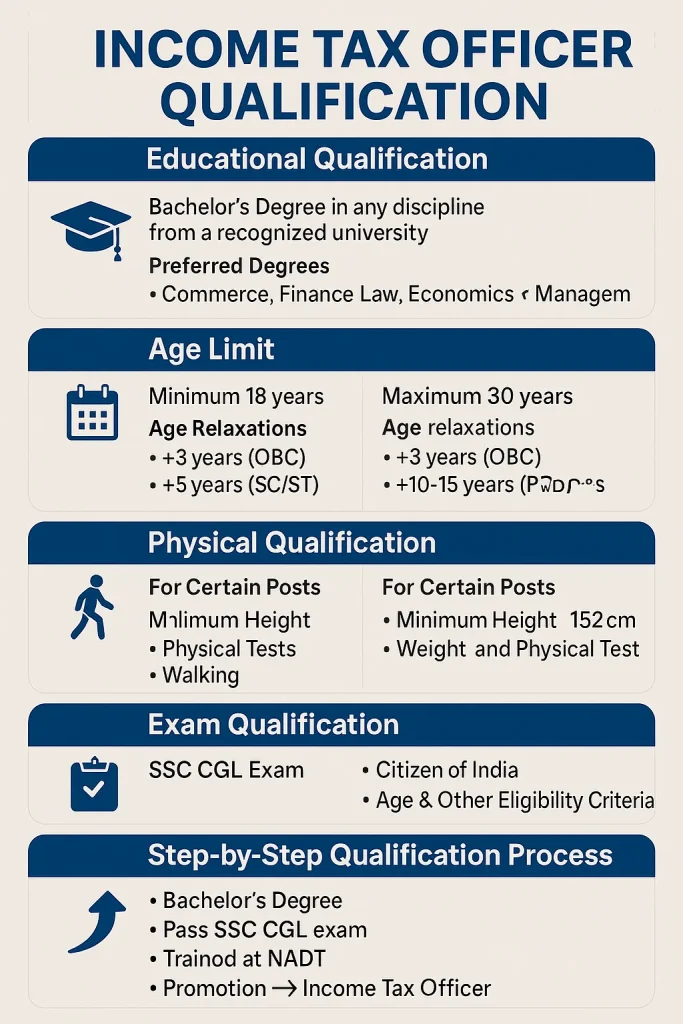

Section 1: Educational Qualification for Income Tax Officer

The minimum educational qualification required is:

Bachelor’s Degree in any discipline from a recognized university (UGC-approved).

This means:

- You can have a degree in Arts, Commerce, Science, Engineering, Law, or Management—all are acceptable.

- Students in their final year of graduation can also apply, but they must complete their degree before the final selection.

Preferred Subjects (Though Not Mandatory)

While any graduate can apply, certain degrees are advantageous:

- Commerce or Finance → Helps in understanding accounting, taxation, and auditing.

- Law → Useful for handling legal disputes and tax-related cases.

- Economics or Statistics → Helps in analysis of income patterns, tax revenue, and auditing.

- Management or MBA → Provides knowledge about business structures and corporate taxation.

Thus, while the qualification requirement is broad, candidates with finance, law, or commerce backgrounds often find the exam subjects more relatable.

Section 2: Age Limit for Income Tax Officer

Age is a key part of the qualification criteria.

General Age Limit

- Minimum Age: 18 years

- Maximum Age: 30 years

Relaxations in Age Limit

The government provides relaxations for reserved categories as per rules:

- OBC: +3 years (up to 33 years)

- SC/ST: +5 years (up to 35 years)

- PwD (General): +10 years

- PwD (OBC): +13 years

- PwD (SC/ST): +15 years

Section 3: Nationality Requirement

To qualify, the candidate must be:

- A citizen of India, OR

- A subject of Nepal or Bhutan, OR

- A Tibetan refugee who came to India before 1 January 1962 with the intention of permanent settlement, OR

- A person of Indian origin who has migrated from Pakistan, Burma, Sri Lanka, East African countries, or Vietnam with the intention of permanent settlement.

Section 4: Physical Qualification (For Certain Posts)

Though not mandatory for all desk roles, certain ITO duties involve fieldwork, raids, and inspections, where physical fitness is necessary. The SSC CGL (Combined Graduate Level) Exam, through which most ITOs are recruited, has prescribed minimum physical standards.

Physical Standards for Male Candidates

- Height: 157.5 cm (relaxable for specific categories)

- Chest: 81 cm (with expansion)

- Physical Tests:

- Walking: 1600 meters in 15 minutes

- Cycling: 8 km in 30 minutes

Physical Standards for Female Candidates

- Height: 152 cm (relaxable for specific categories)

- Weight: Minimum 48 kg

- Physical Tests:

- Walking: 1 km in 20 minutes

- Cycling: 3 km in 25 minutes

Thus, qualification is not just academic—it also includes physical ability for some roles.

Section 5: Exam Qualification – The SSC CGL Route

Educational qualification alone is not enough. To become an Income Tax Officer, candidates must qualify the SSC CGL exam conducted by the Staff Selection Commission (SSC).

Exam Stages

- Tier I (Preliminary Exam) – Objective type, online

- Tier II (Mains Exam) – Multiple papers, online

- Tier III (Descriptive Exam) – Essay/Letter writing, offline

- Tier IV (Skill/Computer Test + Document Verification)

- Interview/Posting – Based on final merit list

Required Score

- You must secure a rank high enough to be placed in the Income Tax Department (CBDT).

- Since ITO is a Group B Gazetted Officer post, the cut-off is usually higher than other posts.

Section 6: Work Experience Requirement

Unlike some jobs, no prior work experience is required. However:

- Candidates must clear the SSC CGL exam.

- After selection, they undergo training at the National Academy of Direct Taxes (NADT), Nagpur.

This training prepares them with legal, financial, and practical knowledge to perform their duties.

Section 7: Step-by-Step Qualification Process

Let’s put everything together:

- Complete Graduation (any discipline).

- Meet Age and Nationality Requirements.

- Fulfill Physical Standards (if applicable).

- Apply for SSC CGL Exam.

- Clear All Tiers of SSC CGL with high marks.

- Rank High Enough to be allotted to Income Tax Department.

- Undergo Training at NADT, Nagpur.

- Join as Income Tax Inspector → Promotion → Income Tax Officer.

Section 8: Promotion and Career Path

Interestingly, most officers don’t directly join as Income Tax Officers. Instead, they start as Income Tax Inspectors and then get promoted.

- Entry Post: Income Tax Inspector (via SSC CGL)

- Next Promotion: Income Tax Officer (after 3–4 years of service + departmental exam)

- Further Promotions:

- Assistant Commissioner of Income Tax (ACIT)

- Deputy Commissioner of Income Tax (DCIT)

- Joint Commissioner of Income Tax (JCIT)

- Additional Commissioner of Income Tax

- Commissioner of Income Tax

- Chief Commissioner of Income Tax

Thus, qualification is just the first step of a long and rewarding career ladder.

Section 9: Skills That Complement Formal Qualifications

While meeting the eligibility qualifications is mandatory, having the following skills boosts success:

- Analytical Skills – For investigating financial data.

- Knowledge of Accounting & Taxation – To interpret balance sheets and ITRs.

- Legal Knowledge – To apply laws correctly in raids and disputes.

- Communication Skills – For interacting with taxpayers and legal authorities.

- Decision-Making Ability – For quick judgments during inspections.

- Physical Stamina – For field duties.

Section 10: Common Questions About Income Tax Officer Qualification

Can I become an Income Tax Officer after 12th?

No. You must be a graduate. However, you can start preparing for SSC CGL after 12th and appear once you complete your degree.

Is Commerce compulsory?

No. Any graduate can apply. But commerce or finance background helps.

3. Is there an interview?

Not always. The final selection depends on merit and preference of post in SSC CGL.

4. Can women apply for Income Tax Officer posts?

Yes. Women have equal eligibility and also receive physical standard relaxations.

5. Do I need prior work experience?

No. Fresh graduates can directly apply and qualify.

Section 11: Real-Life Experiences of Aspirants

Many successful candidates share their journey:

- Some come from small towns with minimal resources but succeed through online coaching and dedication.

- Others rely on self-study with NCERTs, standard books, and practice papers.

- Candidates with Commerce or Law backgrounds often find accountancy and law sections easier, but even engineering or arts graduates succeed with strategy.

This shows that while qualifications are fixed, any determined student can achieve success.

Section 12: Preparation Tips for SSC CGL (ITO Aspirants)

- Start Early: Ideally during graduation.

- Focus on Quantitative Aptitude & Reasoning: Key for Tier I & II.

- Polish English Skills: For descriptive paper and communication.

- Stay Updated with Current Affairs & Economy: Helps in essay writing.

- Mock Tests: Simulate exam conditions.

- Health & Fitness: For physical standards.

Also Read:

- Income tax officer eligibility for female

- Income tax officer exam syllabus

- Income tax department officer list

- Income tax officer car

- Income tax officer salary

Conclusion

The qualification for an Income Tax Officer is straightforward yet competitive:

- A graduate degree in any discipline,

- Meeting the age and nationality requirements,

- Fulfilling physical standards (if required), and

- Successfully clearing SSC CGL with a high rank.

But beyond formal qualifications, becoming an ITO requires discipline, analytical ability, and dedication. With the right preparation, aspirants from any background—whether commerce, law, science, or arts—can secure this prestigious post.

For those dreaming of a stable government job, authority, and the chance to serve the nation by ensuring tax compliance, the Income Tax Officer is one of the best career choices in India.