The post of an Income Tax Officer (ITO) is one of the most respected and rewarding positions under the Government of India.

Apart from authority and prestige, one of the biggest attractions of this career is the impressive salary and benefits package.

Candidates preparing for SSC CGL (Staff Selection Commission – Combined Graduate Level Exam) or UPSC Civil Services Exam (IRS – Income Tax) often ask:

“What is the salary of an Income Tax Officer in India?”

“How much does an Income Tax Officer earn after the 7th Pay Commission?”

“What are the perks, allowances, and promotions like?”

If you have the same questions, this article will give you a complete breakdown of the Income Tax Officer salary structure, including basic pay, grade pay, allowances, in-hand salary, and growth prospects.

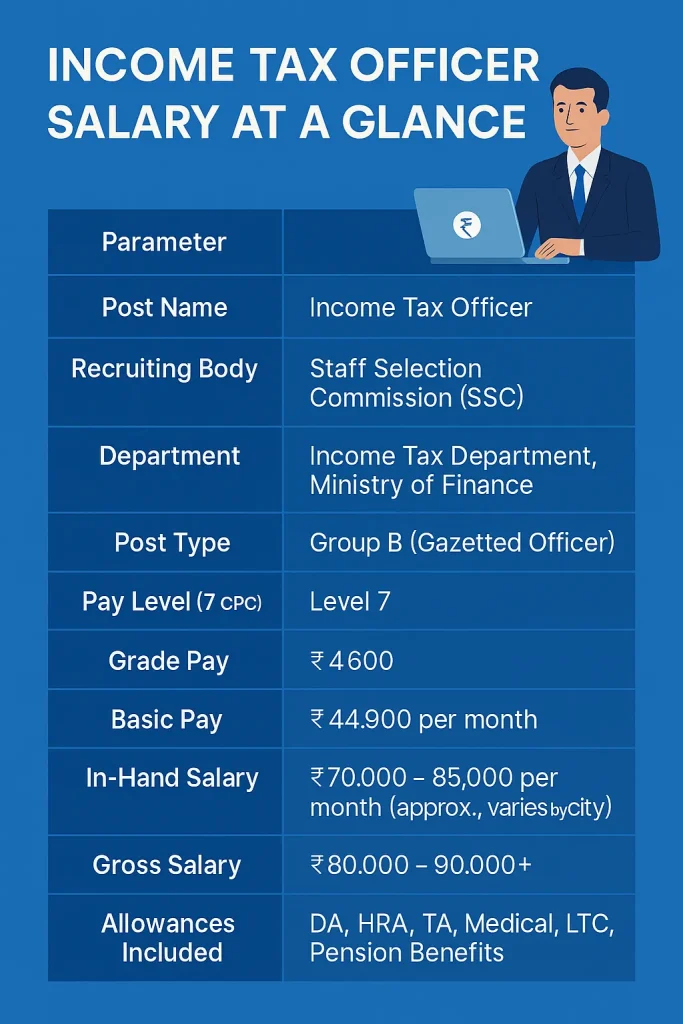

Overview: Income Tax Officer Salary at a Glance

| Parameter | Details |

|---|---|

| Post Name | Income Tax Officer (ITO) |

| Recruiting Body | Staff Selection Commission (SSC) through CGL Exam |

| Department | Income Tax Department, Ministry of Finance |

| Post Type | Group B (Gazetted Officer) |

| Pay Level (7th CPC) | Level 7 |

| Grade Pay (6th CPC) | ₹4600 |

| Basic Pay | ₹44,900 per month |

| In-Hand Salary | ₹70,000 – ₹85,000 per month (approx., varies by city) |

| Gross Salary | ₹80,000 – ₹90,000+ |

| Allowances Included | DA, HRA, TA, Medical, LTC, Pension Benefits |

Table of Contents

1. Income Tax Officer Salary Structure (7th Pay Commission)

After the 7th Pay Commission, government salaries are now decided based on Pay Matrix Levels, not old Grade Pay systems.

For an Income Tax Officer, the relevant Pay Matrix Level is Level 7, which corresponds to the Grade Pay of ₹4600 under the 6th CPC.

Basic Salary Details (Level 7 – Grade Pay ₹4600)

| Component | Amount (Approx.) |

|---|---|

| Basic Pay | ₹44,900 |

| Dearness Allowance (DA) – 46% (as of 2025) | ₹20,654 |

| House Rent Allowance (HRA) – 27% (Metro Cities) | ₹12,123 |

| Transport Allowance (TA) | ₹7,200 |

| Other Allowances | ₹3,000 – ₹4,000 |

| Gross Monthly Salary | ₹88,000 – ₹90,000 |

| In-Hand Salary (After Deductions) | ₹70,000 – ₹80,000 |

2. Income Tax Officer Salary by City Category

The government classifies cities into three categories — X, Y, and Z — based on cost of living. Salary components like HRA and TA vary accordingly.

| City Class | HRA | Approx. In-Hand Salary |

|---|---|---|

| X (Metro) | 27% | ₹78,000 – ₹85,000 |

| Y (Medium Cities) | 18% | ₹72,000 – ₹78,000 |

| Z (Rural Areas) | 9% | ₹68,000 – ₹72,000 |

Examples of City Classification:

- X Class Cities: Delhi, Mumbai, Kolkata, Chennai, Bengaluru, Hyderabad

- Y Class Cities: Jaipur, Pune, Lucknow, Chandigarh, Bhopal

- Z Class Cities: Smaller towns and rural postings

Thus, depending on the posting location, there can be a difference of ₹10,000–₹15,000 in in-hand salary.

3. Salary Slip Example of an Income Tax Officer

Here’s an example of a monthly salary breakup (for an officer posted in Delhi):

| Component | Amount (₹) |

|---|---|

| Basic Pay | 44,900 |

| Dearness Allowance (46%) | 20,654 |

| House Rent Allowance (27%) | 12,123 |

| Transport Allowance | 7,200 |

| Other Allowances | 3,500 |

| Gross Salary | 88,377 |

| Deductions (PF, NPS, Tax, etc.) | 9,200 |

| In-Hand Salary | ≈ ₹79,000 |

This structure makes the Income Tax Officer’s salary one of the most lucrative among all Group B posts in the Indian government.

4. Allowances and Benefits Included in ITO Salary

Income Tax Officers receive a wide range of allowances apart from the basic salary. Let’s go through the key ones.

1. Dearness Allowance (DA)

- Revised twice every year (January & July).

- Currently 46% of the basic pay (as of 2025).

- Compensates for inflation and cost of living increases.

2. House Rent Allowance (HRA)

- Based on city class:

- 27% for X cities

- 18% for Y cities

- 9% for Z cities

- Officers posted in government quarters may not receive HRA but get official accommodation instead.

3. Transport Allowance (TA)

- ₹3,600 to ₹7,200 depending on the city.

- Additional DA applied on TA.

- Officers who use departmental cars for official work may not receive TA separately.

4. Travel Allowance (LTC)

- Leave Travel Concession (LTC) provided every 2 years.

- Covers family travel within India (rail or air).

5. Medical Benefits

- Officers and dependents get free treatment at CGHS hospitals or reimbursement for private care.

6. Pension and NPS Benefits

- Automatic enrollment in the National Pension Scheme (NPS).

- Government contributes 14% of salary to the pension account.

7. Gratuity and Leave Encashment

- Gratuity paid at retirement.

- Up to 300 days of earned leave can be encashed.

8. Field and Raid Allowance (Special)

- Officers engaged in survey, search, or raid operations get extra allowances, such as:

- Daily field duty allowance

- Conveyance and risk allowances

These allowances can significantly boost take-home salary during active field postings.

5. Salary Growth Through Promotions

Income Tax Officers have one of the fastest promotional structures among government jobs, especially for performers.

Here’s how their salary grows with each promotion:

| Post / Designation | Pay Level | Grade Pay (Old) | Approx. Basic Pay | Average Monthly Salary (₹) |

|---|---|---|---|---|

| Inspector of Income Tax | Level 6 | ₹4200 | ₹35,400 | ₹55,000–₹65,000 |

| Income Tax Officer | Level 7 | ₹4600 | ₹44,900 | ₹70,000–₹85,000 |

| Assistant Commissioner (ACIT) | Level 10 | ₹5400 | ₹56,100 | ₹90,000–₹1,00,000 |

| Deputy Commissioner (DCIT) | Level 11 | ₹6600 | ₹67,700 | ₹1,10,000–₹1,20,000 |

| Joint Commissioner (JCIT) | Level 12 | ₹7600 | ₹78,800 | ₹1,30,000+ |

| Additional Commissioner (Addl. CIT) | Level 13 | ₹8700 | ₹1,18,500 | ₹1,60,000+ |

| Commissioner of Income Tax (CIT) | Level 14 | ₹10000 | ₹1,44,200 | ₹1,90,000+ |

| Chief Commissioner (CCIT) | Level 16 | – | ₹2,05,000 | ₹2,25,000 fixed |

So, within a career of 25–30 years, an officer’s salary can grow from ₹70,000 per month to over ₹2.25 lakh per month, not including additional perks.

6. Income Tax Officer Salary After 10 and 20 Years of Service

Let’s see how the salary evolves over time (approximate figures):

| Years of Service | Post Held | Basic Pay Range (₹) | In-Hand Salary (₹) |

|---|---|---|---|

| 0–3 Years | Income Tax Officer | 44,900–49,000 | 70,000–80,000 |

| 5–8 Years | Assistant Commissioner (Promotion) | 56,100–67,700 | 90,000–1,10,000 |

| 10–15 Years | Deputy Commissioner | 67,700–78,800 | 1,10,000–1,30,000 |

| 20+ Years | Commissioner and Above | 1,18,500–2,25,000 | 1,60,000–2,25,000 |

Thus, an ITO’s career progression directly enhances their pay scale, making it a financially rewarding government job.

7. Comparison – ITO vs Other SSC Posts

| Post | Department | Pay Level | Average Monthly Salary |

|---|---|---|---|

| Assistant Section Officer (MEA) | External Affairs | Level 7 | ₹75,000 |

| Assistant Audit Officer | CAG | Level 8 | ₹85,000 |

| Income Tax Officer | Income Tax Department | Level 7 | ₹80,000+ |

| Central Excise Inspector | CBIC | Level 6 | ₹65,000 |

| Assistant Enforcement Officer | ED | Level 7 | ₹75,000 |

| Sub-Inspector (CBI) | CBI | Level 7 | ₹72,000 |

8. IRS (UPSC) vs ITO (SSC) Salary Comparison

| Aspect | Income Tax Officer (SSC Route) | IRS Officer (UPSC Route) |

|---|---|---|

| Entry Post | Income Tax Officer (Group B) | Assistant Commissioner (Group A) |

| Basic Pay | ₹44,900 | ₹56,100 |

| In-Hand Salary | ₹75,000 | ₹1,00,000 |

| Grade Pay (Old) | ₹4600 | ₹5400 |

| Car Facility | For official duty | Full-time with driver |

| Accommodation | Limited | Priority government bungalow |

| Promotion Speed | Moderate | Faster (structured IAS-like path) |

| Highest Post | Principal Chief Commissioner | CBDT Chairman |

Although IRS officers earn more initially, SSC recruits can eventually reach equivalent levels through experience and departmental exams.

9. Deductions from Salary

Every government salary includes certain deductions:

| Deduction Type | Amount (Approx.) |

|---|---|

| NPS Contribution (10%) | ₹4,490 |

| CGHS (Health Insurance) | ₹325 |

| Income Tax | ₹1,500 – ₹2,000 |

| Professional Tax | ₹200 |

| Total Deductions | ₹7,000 – ₹8,500 |

After these deductions, the in-hand pay of an ITO typically ranges between ₹70,000 – ₹80,000 per month.

10. Non-Monetary Benefits

Apart from salary, Income Tax Officers enjoy a lifestyle filled with prestige and influence.

1. Job Security

Permanent central government job with zero risk of layoff.

2. Social Status

High respect in society due to association with taxation and enforcement powers.

3. Government Quarters

Accommodation provided in government colonies, especially in metro cities.

4. Official Vehicle (for field duties)

Access to departmental cars during raids and inspections.

5. Free Mobile and Internet Allowance

Reimbursement of bills for official communication.

6. Holidays and Work-Life Balance

Weekends off, national holidays, and earned leave benefits.

7. Pension and Family Security

Post-retirement pension, gratuity, and family pension.

8. Travel and LTC

Free or reimbursed travel within India under LTC policy.

11. What Makes the Salary Attractive

While the basic pay may look moderate, the allowances, field incentives, and perks make this one of the most rewarding jobs in India.

Example:

An officer posted in Delhi may receive:

- DA + HRA + TA = ₹40,000+

- Fuel + Car + Driver = ₹15,000 (non-cash equivalent)

- Field Allowances = ₹5,000–₹10,000

Total benefits = ₹1 lakh+ monthly (equivalent value).

This makes the effective earning potential of an ITO far beyond the base salary.

12. Career Growth and Salary Hike Timeline

An ITO’s annual increment is 3% of basic pay, plus revisions after pay commissions.

Annual Increment Example:

- 1st Year: ₹44,900

- 2nd Year: ₹46,247

- 3rd Year: ₹47,634

- 4th Year: ₹49,063

- … and so on.

Additionally, every promotion (roughly every 5–8 years) brings a huge salary jump.

13. Why Salary Shouldn’t Be the Only Motivation

While the salary of an Income Tax Officer is attractive, what truly makes the job special is:

- Authority and Decision-Making Power

- Contribution to National Revenue

- Opportunities for continuous learning

- Fieldwork excitement (raids, investigations)

- Balanced professional life

So, beyond the paycheck, it’s a career of service and prestige.

Conclusion

The Income Tax Officer salary in India is among the highest in the SSC CGL cadre and offers a perfect blend of financial stability, professional authority, and lifelong benefits.

To summarize:

- Basic Pay: ₹44,900 per month (Level 7)

- In-Hand Salary: ₹70,000 – ₹85,000

- Gross Pay: ₹90,000+

- Total Benefits (with perks): ₹1 lakh+ monthly value

- Growth: Can reach ₹2.25 lakh/month at senior levels

With consistent increments, promotions, and allowances, this post offers not just an excellent salary but also a prestigious government career with influence, security, and respect.

If you’re preparing for SSC CGL, remember — clearing the exam doesn’t just bring you a high-paying government job; it gives you a lifetime of dignity and opportunity in the Income Tax Department.