When it comes to government jobs in India, one of the most respected and sought-after positions is that of an Income Tax Officer (ITO).

Every year, lakhs of candidates prepare for competitive examinations with the dream of securing this prestigious post.

But before starting such preparation, it’s important to understand exactly what the work of an income tax officer is.

This article explores the roles, responsibilities, daily tasks, powers, and significance of an Income Tax Officer in India.

We’ll also discuss how their work impacts the country’s economy, the challenges they face, and the difference between fieldwork and office work.

Table of Contents

Who is an Income Tax Officer?

An Income Tax Officer (ITO) is an officer in the Income Tax Department of India, which functions under the Central Board of Direct Taxes (CBDT), Ministry of Finance.

Their primary role is to enforce the provisions of the Income Tax Act, 1961, and ensure the collection of taxes on income and wealth.

They are responsible for assessing, collecting, and preventing tax evasion, while also serving as a link between the government and taxpayers.

The job is both administrative and investigative in nature, requiring analytical skills, legal knowledge, and field activity.

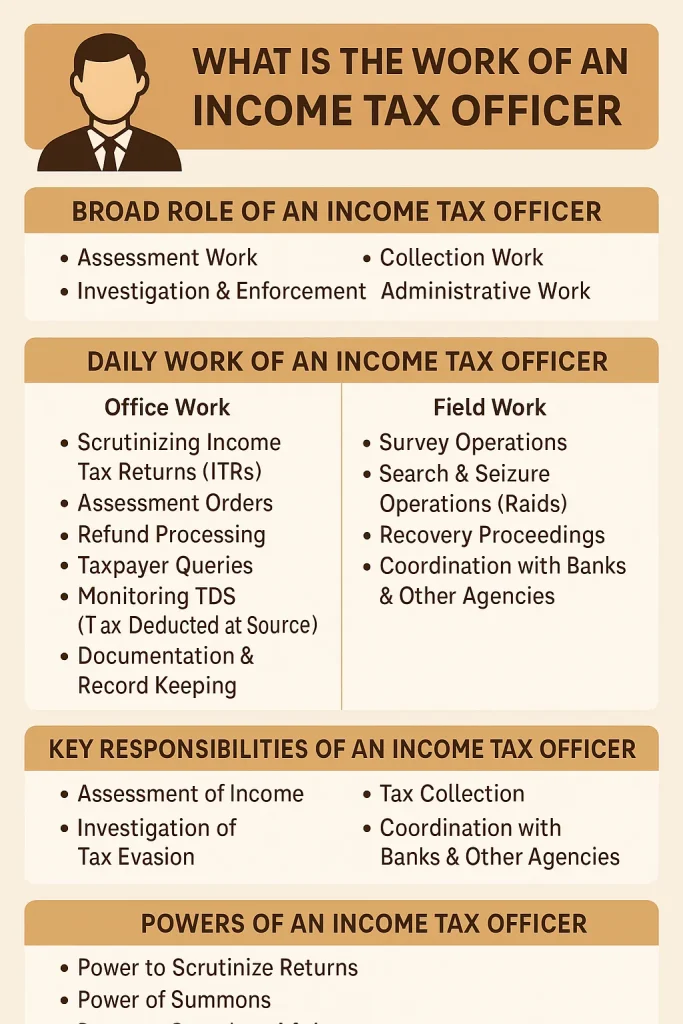

Broad Role of an Income Tax Officer

The role of an ITO can be divided into four major categories:

- Assessment Work – Examining tax returns, calculating tax liability, and ensuring compliance with income tax rules.

- Collection Work – Ensuring taxpayers pay the due amount of tax within deadlines.

- Investigation & Enforcement – Detecting tax evasion, conducting raids, and gathering intelligence.

- Administrative Work – Supervising staff, coordinating with other government agencies, and reporting to senior officials.

Daily Work of an Income Tax Officer

The daily routine of an ITO varies depending on whether they are working in the Assessment Wing, Investigation Wing, or Enforcement Wing. Below are the common tasks:

Office Work

- Scrutinizing Income Tax Returns (ITRs): Examining individual and corporate tax returns for accuracy.

- Assessment Orders: Calculating the final tax liability of taxpayers.

- Refund Processing: Approving refunds in cases of excess tax paid.

- Taxpayer Queries: Meeting taxpayers and solving their doubts.

- Monitoring TDS (Tax Deducted at Source): Ensuring that employers and institutions are deducting and depositing TDS properly.

- Documentation & Record Keeping: Maintaining detailed records of taxpayers, assessments, and audits.

Field Work

- Survey Operations (Sec 133A of Income Tax Act): Visiting business premises to verify accounts and detect discrepancies.

- Search & Seizure Operations (Raids): Conducting raids on individuals or organizations suspected of tax evasion.

- Recovery Proceedings: Visiting defaulters to collect pending tax dues.

- Coordination with Banks & Other Agencies: Obtaining financial information to track unreported income.

Key Responsibilities of an Income Tax Officer

The responsibilities can be detailed into the following areas:

Assessment of Income

- Examining income sources of individuals, firms, and companies.

- Identifying underreported income.

- Checking exemptions and deductions claimed under the Income Tax Act.

Tax Collection

- Ensuring timely payment of advance tax, self-assessment tax, and TDS.

- Initiating legal recovery proceedings in case of non-payment.

- Attaching bank accounts or property of defaulters if necessary.

Investigation of Tax Evasion

- Identifying individuals or entities that evade taxes.

- Conducting intelligence-based investigations.

- Collaborating with Enforcement Directorate (ED) and Central Bureau of Investigation (CBI) if money laundering is suspected.

Conducting Raids

- Gathering information about hidden income.

- Conducting raids with proper legal authorization.

- Seizing unaccounted cash, gold, documents, and digital evidence.

Handling Appeals

- Representing the department in cases where taxpayers dispute assessments.

- Preparing legal documents and providing justifications before appellate authorities.

Administrative Supervision

- Supervising Inspectors and Tax Assistants.

- Training and guiding junior staff.

- Ensuring smooth functioning of the Income Tax office.

Powers of an Income Tax Officer

Income Tax Officers are vested with significant legal powers under the Income Tax Act. These include:

- Power to Scrutinize Returns – They can demand additional documents from taxpayers.

- Power of Summons – They can summon individuals for questioning regarding their income.

- Power to Search and Seize – They can raid premises with approval from higher authorities.

- Power of Assessment – They can finalize the tax liability of individuals or companies.

- Power of Recovery – They can attach bank accounts, seize property, or auction assets.

These powers make their role highly influential but also demand honesty, integrity, and responsibility.

Different Wings Where ITOs Work

Income Tax Officers may be posted in different wings of the department:

Assessment Wing

Handles the scrutiny of tax returns and passing of assessment orders.

Investigation Wing

Focuses on intelligence gathering, raids, and surveys to detect tax evasion.

TDS Wing

Ensures compliance with TDS provisions.

International Taxation Wing

Deals with foreign companies, NRIs, and double taxation issues.

Transfer Pricing Wing

Examines multinational corporations for fair pricing of international transactions.

Work-Life of an Income Tax Officer

The work life of an ITO depends on the posting:

- Desk Posting: 9–5 office work, mostly dealing with files and taxpayers.

- Field Posting: Irregular timings, late-night raids, and surprise surveys.

- Metropolitan Cities: High workload due to more businesses and taxpayers.

- Smaller Cities: Relatively less pressure, but responsibility remains high.

Overall, the job is challenging but also rewarding in terms of respect and career growth.

How Income Tax Officers Contribute to the Nation

The work of Income Tax Officers is not limited to just collecting money for the government. Their work contributes to:

- Nation Building: Taxes collected are used for infrastructure, healthcare, and education.

- Economic Stability: Preventing black money circulation ensures fair economy.

- Legal Enforcement: They uphold the rule of law by punishing evasion.

- Fairness in Society: By catching tax evaders, they ensure honest taxpayers are not burdened.

Challenges in the Work of Income Tax Officers

While the job is prestigious, it comes with challenges:

- Pressure of Targets: Officers often have deadlines for tax collection.

- Workload: High volume of cases in metro postings.

- Field Risks: Raids may involve resistance or even threats.

- Legal Complexity: Keeping up with frequent changes in tax laws.

- Public Perception: Sometimes seen as harsh enforcers rather than facilitators.

A Day in the Life of an Income Tax Officer

A typical day may include:

- Morning: Reviewing files, checking ITRs, attending meetings.

- Afternoon: Meeting taxpayers, hearings, or visiting business premises.

- Evening: Preparing reports, finalizing assessments, or coordinating for raids.

- Late Night (occasionally): Conducting surprise raids or investigations.

Real-Life Examples of Income Tax Officer Work

- Search Operations: Large corporate houses, celebrities, and politicians often face IT raids for suspected tax evasion.

- Survey Operations: Shops, small businesses, or real estate developers are frequently surveyed.

- High-Profile Investigations: Linking unaccounted wealth with money laundering cases.

Such cases show the crucial role ITOs play in maintaining financial transparency in society.

Career Growth of an Income Tax Officer

An ITO starts as a Group B Gazetted Officer and can rise through promotions:

- Income Tax Officer

- Assistant Commissioner of Income Tax (ACIT)

- Deputy Commissioner (DCIT)

- Joint Commissioner (JCIT)

- Additional Commissioner

- Commissioner of Income Tax (CIT)

- Chief Commissioner of Income Tax (CCIT)

Each promotion brings more responsibility, authority, and a wider role in shaping taxation policy.

Skills Required to Excel in the Job

- Analytical Ability: To detect discrepancies in financial data.

- Legal Knowledge: Familiarity with tax laws and regulations.

- Communication Skills: Handling taxpayers and presenting cases.

- Integrity & Ethics: Essential due to sensitive financial information.

- Decision Making: Quick and correct decisions during raids and assessments.

Also Read:

- Income tax officer eligibility for female

- How to become a income tax officer after 12th

- Income tax officer exam syllabus

- Income tax officer age limit

- Facilities of income tax officer

- Income tax officer qualification?

- Income tax department officer list

- Income tax officer salary

- Income tax officer car

Conclusion

The work of an Income Tax Officer is diverse, challenging, and highly impactful. From scrutinizing income tax returns to conducting late-night raids, their responsibilities ensure tax compliance, revenue generation, and fairness in the economy.

It is a job that requires a balance of office work, field duty, and legal expertise. Beyond the challenges, an ITO’s work directly contributes to nation-building and maintaining the financial backbone of India.

For aspirants preparing for this career, understanding the nature of the work is the first step. It is not just a government job; it is a service to the nation that comes with respect, responsibility, and lifelong learning.